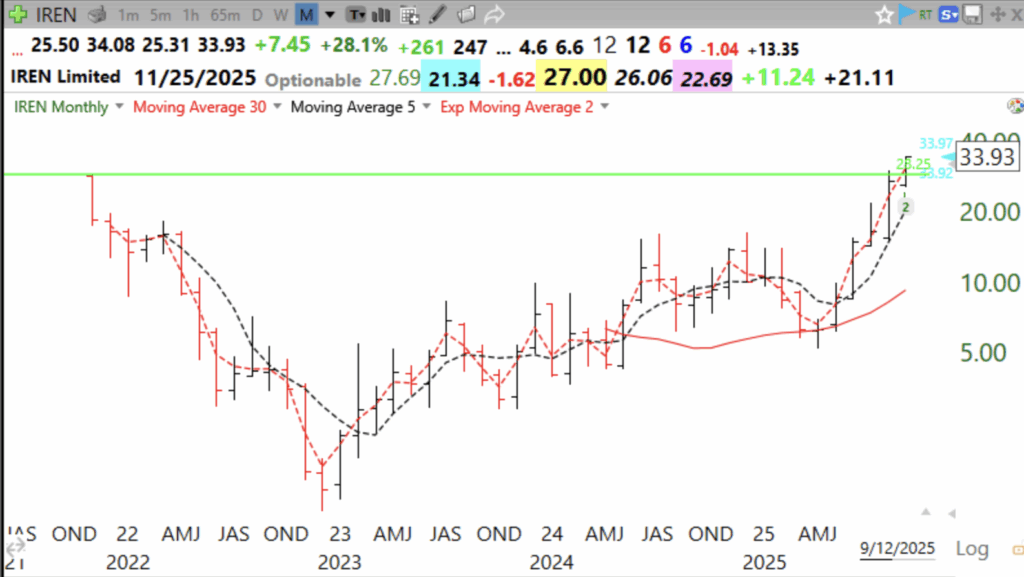

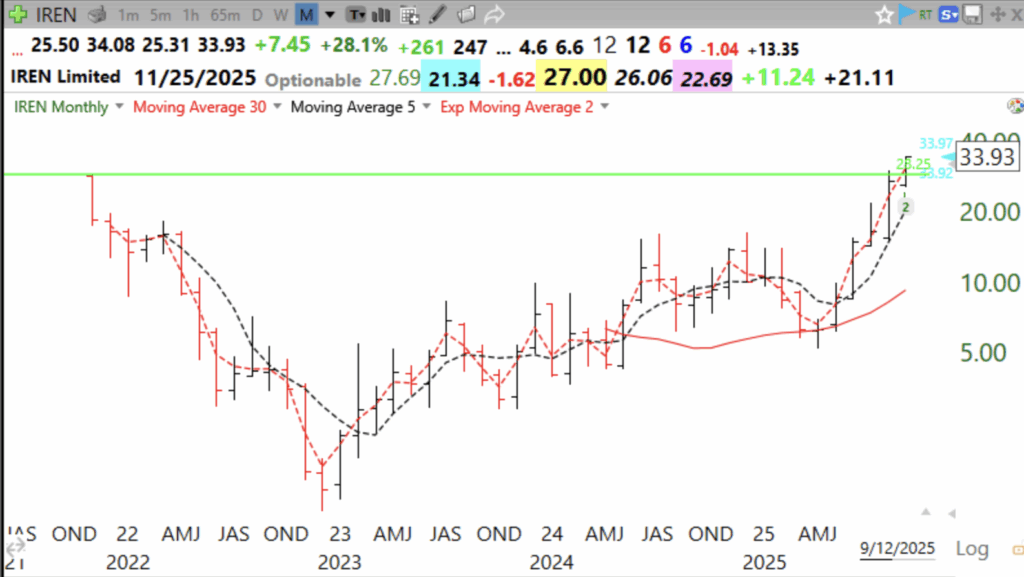

IREN has high volume advances and is trending with its 5 EMA. It is almost 5x its price a year ago. It has strong fundamentals, check it out. Below are its daily and monthly charts. It must not CLOSE below green line @28.25.

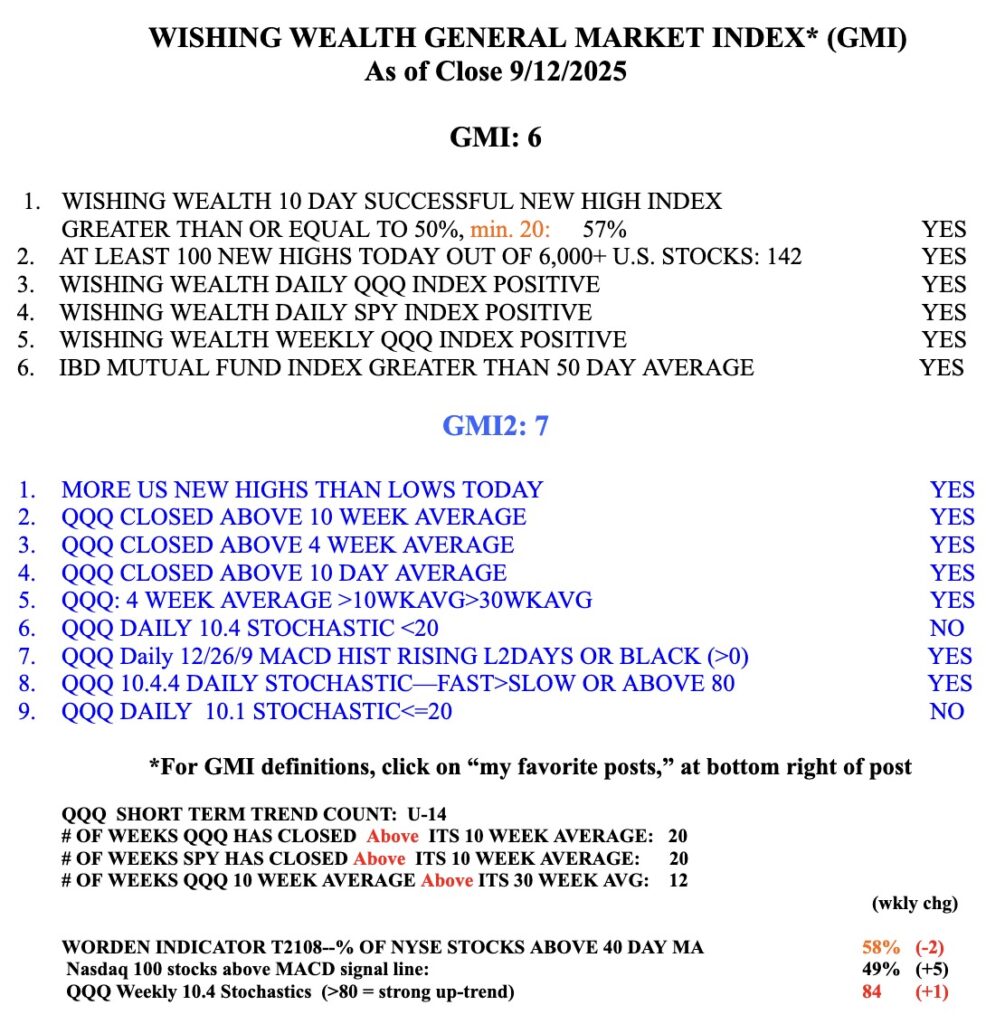

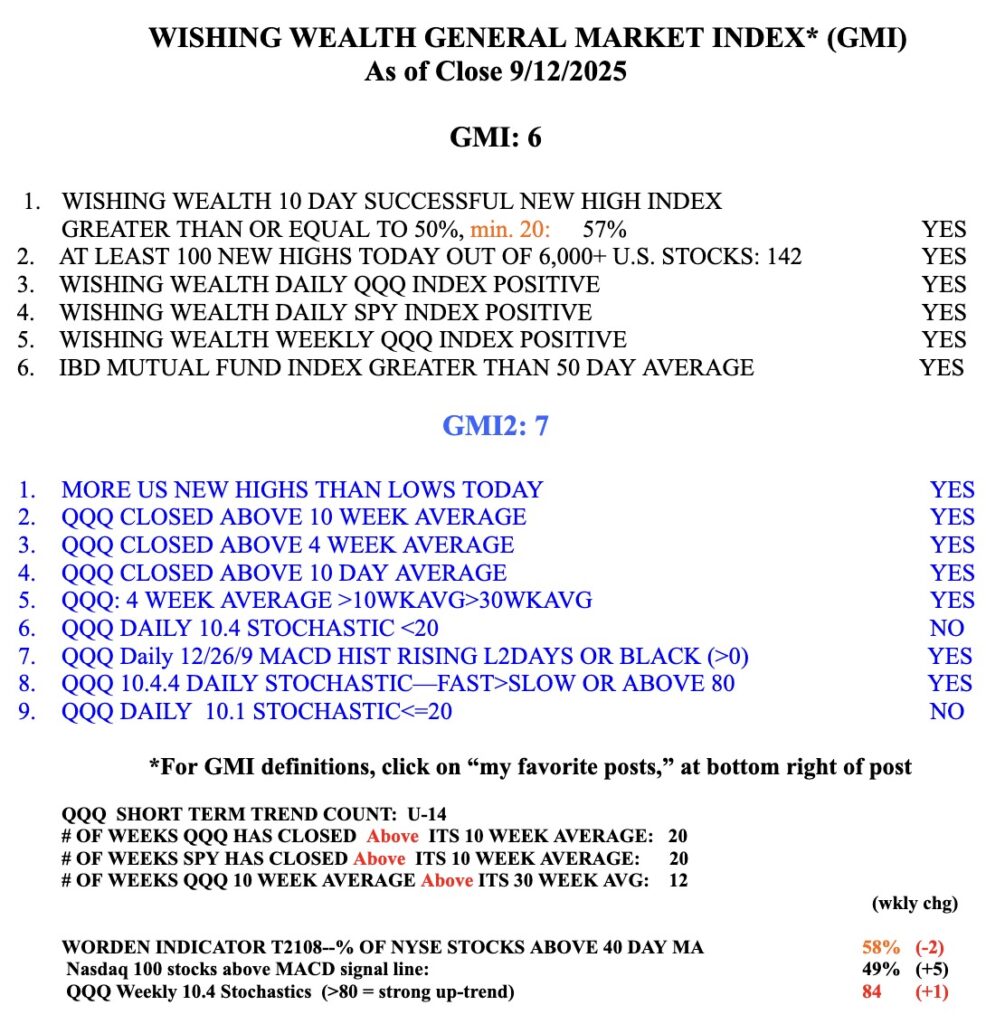

Stock Market Technical Indicators & Analysis

IREN has high volume advances and is trending with its 5 EMA. It is almost 5x its price a year ago. It has strong fundamentals, check it out. Below are its daily and monthly charts. It must not CLOSE below green line @28.25.

IREN caught my eye when it hit an ATH on above average volume on Tuesday and closed back above its green line. Note the high volume GLB a few days ago. It has an IBD/MS COMP=94 and the ACC/DIS rating=A+, RS=99 and it is expected to become profitable this year.

IREN is a recent IPO and just broke its green line top from 11/2021. I like this monthly chart! It must not CLOSE back below its green line @28.25.