I leave town for a few days, and the market rallys. In my defense, I remind you that my previous post did say that I saw some signs of strength in the market. I noted a bullish divergence in the MACD and more new highs (94) than I had seen in a long time. However, I failed to pay any attention to another major sign of strength given off by the market–its failure to decline after the terrorist plot in Britain was announced. The market glass is always half full or empty and the way that the market responds to major events provides valuable clues as to how the masses are feeling towards stocks. (The same is true about how the market responds to news regarding individual stocks.)

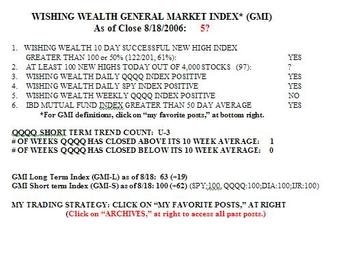

So the GMI rose to 5 on Thursday and remains a 5? after Friday’s action, questionable because there were only 97 (very close to the 100 needed to turn that index positive) new highs in my universe of 4,000 stocks. However, the GMI-S is now at 100, indicating that all of my short term indicators for four major stock indexes are positive. However, the longer term GMI-L is 63, and the Weekly QQQQ Index in the GMI is still negative. The QQQQ is finally back above its 10 week average but remains below its key 30 week average. In contrast, the SPY and DIA are above both their 10 week and and 30 week averages. Five times as many stocks in my universe are within 5% of their yearly highs than their lows (21% vs. 4%).

As I read these statistics, it looks like the short term trends for the stocks represented by DIA, SPY, QQQQ and IJR are up. The longer term trends for the large cap stocks (SPY and DIA) are also up. Thus, this appears to be a tradeable rally and I closed out all of my short positions and have been slowly wading into the market on the long side.

The IBD 100 stocks are still underperforming. 23% of the IBD 100 stocks from 5/15 are in a short term up-trend, compared with 47% of my universe of 4,000 stocks. Since the 5/15 IBD 100 list was published, 21% have risen, compared with 45% of my stock universe. Only one of the stocks on the IBD 100 list from 5/15 hit a new high on Friday (DRIV), and only three of the stocks on the IBD 100 list for 8/14 hit a new high (DRIV, NVEC and PNFP)…

In my early years in the markets during the 60’s and 70’s, I noticed that after each major decline the new bull market would rise on record daily trading volume. Back then, I remember the first time daily volume reached 10 million shares. This trend towards higher volume with each advancing market has continued to this day, so that now daily trading volume is measured in billions of shares. I therefore reasoned in my youth that it was pretty much a certainty that the stock brokerage industry (Darvas considered them to be the casinos) had to prosper with each new bull market. So if I bet on any industry to recover from a declining market it would be the stock brokers(bet on the house). But which brokers to buy?  I want to diversify across a few of the big brokers so I do not get stuck with just one or two laggards. Fortunately, since May there is a new ETF that includes a number of stocks in the U.S. brokerage industry (IAI). If this up-trend is for real, I will watch this ETF very closely……….

I want to diversify across a few of the big brokers so I do not get stuck with just one or two laggards. Fortunately, since May there is a new ETF that includes a number of stocks in the U.S. brokerage industry (IAI). If this up-trend is for real, I will watch this ETF very closely……….

Please send your comments to: silentknight@wishingwealthblog.com.