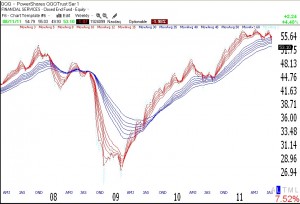

It is interesting that the media pundits, including Cramer, are dubious about this being the bottom of the decline. Bearish talk like that makes me more optimistic. But, alas, I trade on the market’s behavior, not on the media’s hopes and fears. There were three 52 week new highs and 170 new lows in my universe of 4,000 stock on Thursday. Buying stocks at or near new highs is a losing proposition now. AAPL. GMCR are holding up, but for how long? I remain in cash in my IRA and margin account. I am hoping to get out of some of my university pension mutual funds on Friday. I want to reduce exposure to this market. I must admit, though, that the weekly GMMA chart below still does not look very bearish right now. All shorter moving averages (red) are still above or just touching their longer term averages (blue). We are either in a mild correction or at the beginning of a major decline. (Click on chart to enlarge.) Time will tell……..

Vector Vest comment on evening of Friday August 12, 2011 re market:

On a closing basis the Mighty Dow traveled 2,134 points to close the week down 176 points at 11,269. Our trustworthy VV DJIA fell 487 points to 12,334. It is now 9.5% above the Mighty Dow and is saying that the Dow is fairly valued. The Price of the V V C fell $0.33 for the week and the Value of the V V C fell $0.75. The Value of the V V C is now 6.8% below the Price of the V V C and is saying that the market is fully valued.

The market has bottomed! So says Charlie Miller. Take a look at his analysis.