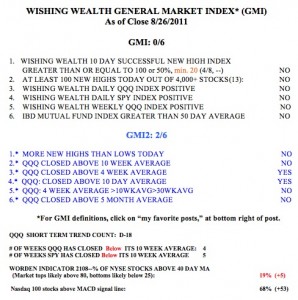

I am still waiting for to see whether this base will hold. Friday was the 18th day of the QQQ short term down-trend. The longer term trend remains down. It is very tempting to nibble at stocks that are rebounding. The problem is that the decline could resume quickly for such stocks. It is much safer to own stocks when the GMI is at least 4. With the GMI still at zero, I will let the bottom feeders get in before me. When my indicators signal a true up-trend, I will get back in. A trend follower always waits for a trend to develop and therefore identifies bottoms and tops after they have been established. The GMI2 contains several more sensitive short term indicators which can turn up in a counter-trend rally during a down-trend. Friday was the 18th day (D-18) of the current QQQ short term down-trend. Only 2 of the 9 leaders I follow have closed above their critical 10 week averages: AAPL and AZO.

Guess Irene helped boost the market ! It’s coming back with a revenge! Where is the downtrend? I am raising my STOP order, so if it goes south, I will come out even in the wash!

The price action was pretty but the volume was so light, that I don’t buy this strength yet. Also, I think corrections of this magnitude require a longer time to put in a bottom. Any thoughts?