If the market holds on Monday the new QQQ short term up-trend will have reached 5 days. At that point I will add to my position in QLD. It is also the 7th day since my GMI based strategy flashed a buy signal. While I am not ready to release our recent analysis of how this strategy has worked since late 2006, I can tell you that the strategy outperformed a buy and hold strategy while keeping me out of the market during market declines. While past results do not guarantee future results, I am confident enough to go long QQQ or QLD when the GMI has flashed a buy signal and remains bullish.

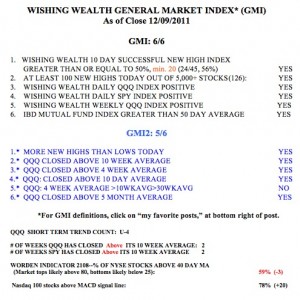

Meanwhile, the GMI remains at 6 (of 6) and the GMI-2 is at 5 (of 6). The Worden T2108 is at 59%, in neutral territory. 78% of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. Both the SPY and QQQ have now closed above their 10 week averages for two weeks. The QQQ daily stochastics reached an overbought level and recently that has led to a rapid decline. The fact that the market held on Friday is a very positive sign. Continued strength would signal to me a change in trend and a break out of the trading range it has been in.

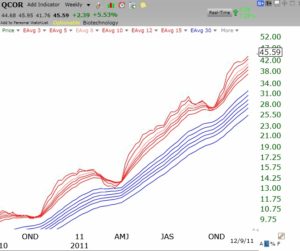

My scan of stocks with good fundamentals that hit a new high on Friday yielded 13 out of more than 5,000 stocks: ORLY,ARG,DCI,HIBB,QCOR,CRMT,FICO,HSNI,SWI,DXPE,GNRC,HPY,SMP. Four of these also came up in my DARVAS scan: QCOR,FICO,SWI,DXPE. These stocks are worth researching for possible buys. As this weekly GMMA chart shows, QCOR has been a powerful RWB rocket stock for some time. Click on chart to enlarge.

Monday, December 12, 10:52 AM Josh Brown’s “big lesson” of 2011 is that market timing has become “a fool’s game,” and investors will increasingly seek dividend-paying stocks after boring but high-yielding utilities (up 14% YTD) and consumer defensives (up 11.3% YTD) have trounced the market. Buy-and-hold is still worthwhile, but “only if some kind of current income… is part of your return expectations.”

Tommy Finger Comments:As I once told Oscar Wilde, “It is better to have a permanent income than to be fascinating.”

I agree that market timing is difficult, but the Josh Brown quote sounds to me like “those who timed the market correctly by buying utilities and consumer defensives made a killing.” It looks like he’s recommending buying and holding with information that only looks good because of market timing?

Do you consider market volume in any of your market “barometers”?

Sometimes.