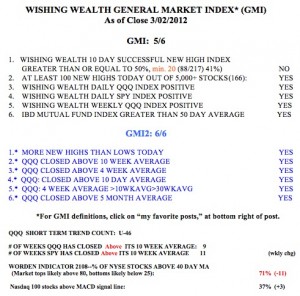

The market has weakened just a little. This week we will see if AAPL will fall after its product news is released. If it does, we might get that several week post earnings release lull until the end of March when mutual funds will engage in window dressing of their portfolios so they will look good to investors. We might then see a rise as first quarter earnings are released in early April. I am hoping this scenario comes true. Meanwhile the GMI dropped one, to 5 but the buy signal of 12/23 remains intact. Friday was the 46th day of the current QQQ short term up-trend. The T2108 is finally moving out of over-bought territory, but is still far above the level where a new up-trend in that indicator typically begins. With these mixed signals, I am inclined to wait a few days to see if this market rally holds up.