I bought more AAPL on Friday because the stock is in an up-trend and found support again at its 30 day average. With the announcement Sunday night of the long expected deal between AAPL and China Mobile, I suspect the QQQ and other tech stocks will rally strongly. (With end of quarter window dressing in play, the strongest stocks should rally anyway.) Note the two recent times that AAPL has found support at its 30 day average. I suspect AAPL could next approach the upper Bollinger Band, around $570.

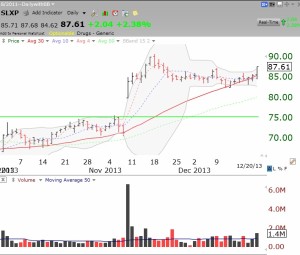

Another up-trending stock I noticed that has bounced off of support is SLXP. It broke out above its green line top (all time high) with huge volume and has now consolidated and found support at its 30 day average. It may have begun a BB expansion on Friday. I may buy some SLXP Monday, with a sell stop around $84.59.

Meanwhile, somebody is buying NVAX. Look at the huge up volume (black) spikes.

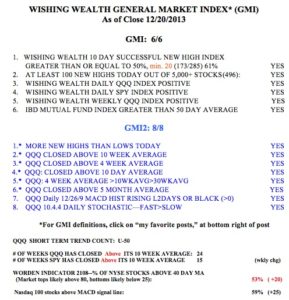

Here is the GMI table. All of my indicators are positive.

Here is the GMI table. All of my indicators are positive.