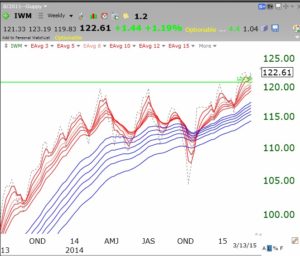

IBD still sees market up-trend under pressure. The GMI is still on a Buy signal from January, but is holding to a middle 3 our of 6. The new QQQ short term down-trend must reach at least 5 days for me to be more confident about it. Interestingly, the IWM, Russell 2000 ETF , seems to be showing a lot of relative strength, having just broken above its green line top to an all-time high. Clearly, small-cap stocks are out-performing large-caps right now.

Here is the GMI table. The SPY has now closed below its 10 week average.

Here is the GMI table. The SPY has now closed below its 10 week average.