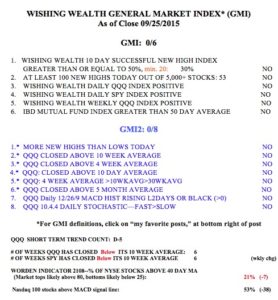

Nobody knows when this market will find a bottom. Note in this “naked” weekly chart of the QQQ, the 4wkavg(red dotted)<10wkavg(blue dotted)<30wkavg (solid red line). This is my primary definition of a “submarine” pattern. It shows a stock or ETF in a significant down-trend. I am in cash in both my university pension and all trading accounts. There is so much time to be invested when the indexes are in a rising “rocket” pattern. Note this was the case from July 2014 until recently, when the blue dotted line was rising above its rising red line. When the 4 and 10 lines move back above the red line, I will begin to look for long positions.

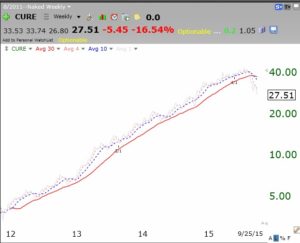

For the past 4 years one could ride the health care stocks in the 3X bullish ETF, CURE. For the first time since 2012, CURE’s 10 week average is now below its 30 week average. The leaders are starting to turn down……

The GMI and GMI-2 are both registering 0.