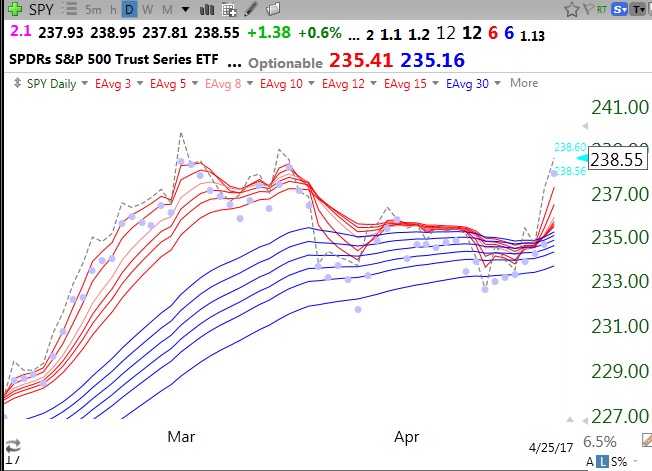

SPY (and DIA and QQQ) is now back to a 12/6/6 daily RWB pattern.

Share this:

- Click to email a link to a friend (Opens in new window) Email

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to print (Opens in new window) Print

- More

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

Without intending to be snarky here — seems worth pointing out that the start of the “QQQ short term downtrend” perfectly nailed the short term bottom and would have been a nice buy signal. So again the entry on the uptrend was above the exit on the downtrend. In the context of a longer term trend, these short term signals do not seem very effective, if you want to use them as exit/entry signals. And again I’ll point out the problem with the GMMA averages: if you want to use them for exit/entry you are most likely going to be selling low, buying high

While no indicator is perfect, the facts do not support your hypothesis. The GMI has kept me out of bad markets and in good markets for a long time.