A trend follower discerns the likely current trend of the market or stocks and rides it until it ends. S/he enters after a bottom and exits after a top is formed. Jesse Livermore said the big money is made by staying with one’s winning position until there is evidence of a change in the stock’s behavior. In spite of the many people who subscribe to this approach, it amazes me that so many of us seem unable to resist the temptation to proclaim tops and bottoms before they occur! Is it just ego and attempts to appear smart? For me, part of the answer is that the day that I will depend on my pension accounts for survival grows ever near and I become more of a chicken with my trading. So I exit too soon.

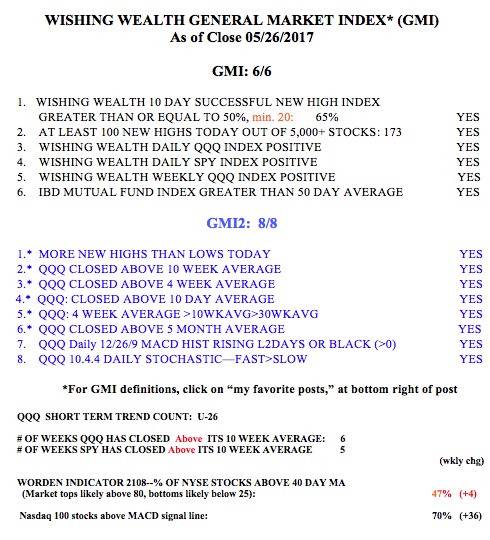

But the major market indexes remain in Weinstein Stage II up-trends, and I have been resisting it by holding back and looking to take profits before the expected dreaded decline begins. However, my GMI indicators did alert me to get out of the market in 2000 and 2008 before most of the carnage. So why should I disregard what they are telling me now? Therefore, with the GMI at 6 (of 6, see table below) I am continuing to hold stocks and keep my university pensions fully invested.

But I repeatedly took profits in my trading accounts and sold out of many stocks that have continued to climb to the sky. I am therefore working on correcting that weakness in my trading by focusing more on weekly charts than daily charts. One would go crazy checking his blood pressure or cholesterol levels multiple times each day. I believe that focusing on daily charts has worked against me as a part-time trader also managing a full-time job. I have reviewed many of the stocks I exited on their daily chart because of weakening technical signals, only to see that there were no danger signals showing up on their weekly charts. You might want to try this type of review exercise for yourselves. I recall that William O’Neil relied primarily on weekly charts. What did he know about this that I do not? I think I am on the right track and will discuss these ideas in my future posts as I figure it out….

I too have started to look at the weekly charts. I get in and out just a little later but I’m not concerned about the daily noise and that is liberating.

I appreciate your insights. Stan’s book still stands the test of time.

According to your posts, you do in fact try to anticipate market turns and ignore the GMI. The last dip, two or so weeks ago you went to cash, yet the GMI had not confirmed a trend change. That is not trend following.

Nice blog.Very useful.Thanks for sharing.

I too as a long-time Mkt participant have noticed the difference between your stated and taught system and methods, and what you actually do. I’m retired now but in a “prior life” encountered life & death risk on a near daily basis. I’ve always believed and taught that risk does not “permission” actions or activities but is simply a yardstick used to calibrate planning, preparation, and the care used in mission execution. I’m not sure how your nearness to retirement is a factor in market endeavors?

Well, I appreciate your honesty and admission of this weakness. I have been following your blog for years and I have beat myself up for doing this too, asking myself why I jumped the gun. Knowing that you struggle with it helps me feel less bad about my mistakes, and encourages me to do the same thing you are and take a closer look at my past behavior and try to find a way to be more disciplined. Thank you for continuing to share your insights daily, and for showing that you are human too.

Eric thank you for your post and honesty on trend trading. We all fall prey to fear and doubt, I believe subconsciously we grab our profits in fear not to lose them like I lost on a past trade. I feel I listen to all the noise around me that clouds my judgment trying to see if I get an edge. After years of reading all the books it comes down to ”Plan the Trade, Trade the Plan , Limit Risk and let the Winners Run” a very simple concept, but I find at times so hard to implement due to my psychology. I think in the books I read the pros tune out the noise trade from a mountain top they don’t get their minds cluttered that create the fear and anxiety. In the game we should remember were going to lose on more trades then win and that’s kind of struggle with, therefore I win a lot trades but don’t make the big returns because always pulling the trigger way too early. Like you I continue to work hoping I can break thru…

Thank you for your thoughtful comment. We all fight the fear and greed emotions. As long as we control the size of our more plentiful losses we can prosper trading.

And thank you to you!