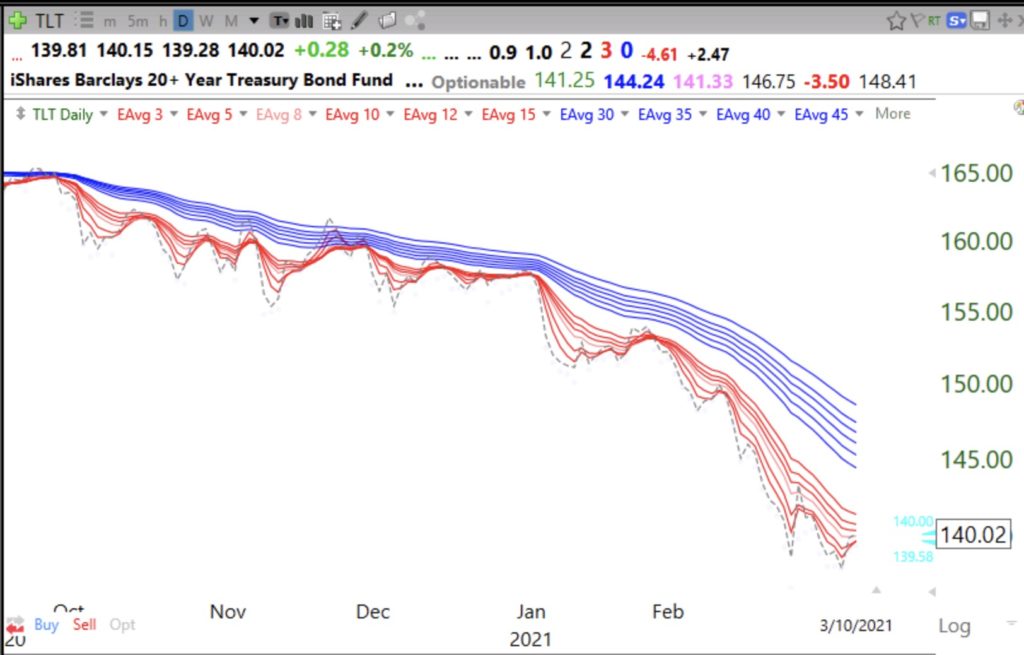

I know the GMI is now on a Green signal but the QQQ remains in a short term down-trend. Since I trade growth stocks, I am still on the sidelines until the QQQ short term trend turns up. If the growth stocks don’t rally, maybe we wait until the stocks left behind the past year have their day and then we enter a real major decline? I am watching the bonds for a clue. Falling bonds means higher interest rates which leads to a declining market. Below is the TLT, 20 year treasury bond chart. TLT remains in a daily BWR decline.

As is IEF, the 7-10 year treasury bond ETF.

I don’t trust this rally in the Dow stocks.