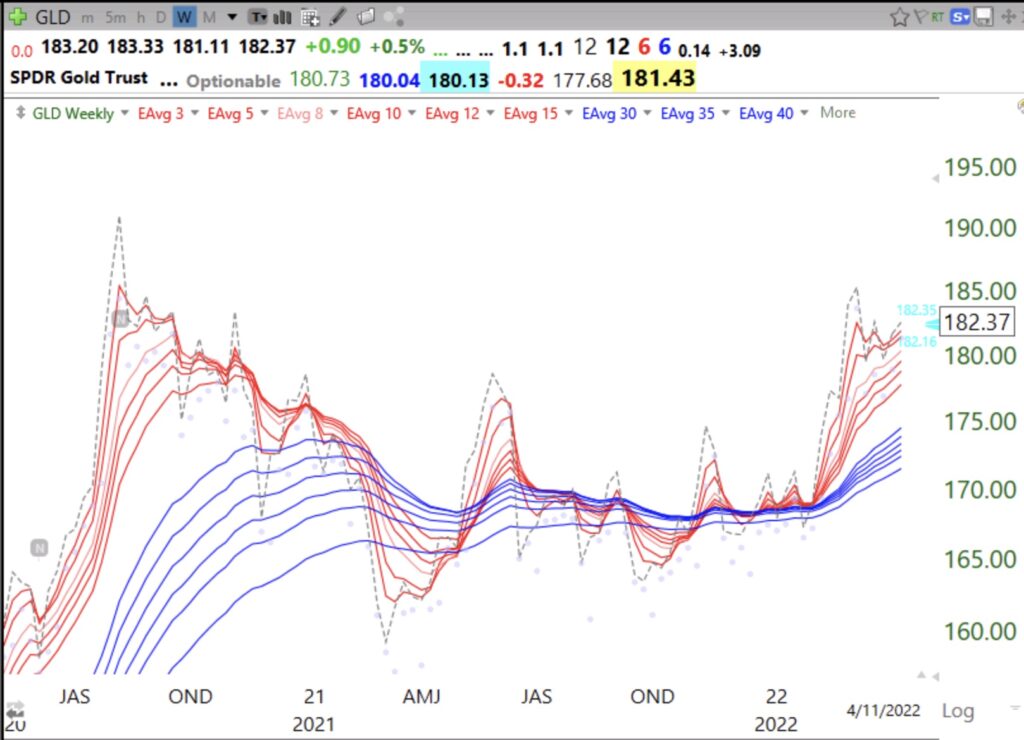

The markets are weak in anticipation of a high CPI number tomorrow and raging inflation QQQ is in a Stage 4 down-trend and I have drawn in one trend line in the weekly chart where it could find support. It looks to me like an ominous head and shoulders top pattern. The lower right shoulder is a special sign of weakness. I am mainly in cash and holding a little SQQQ and $UGL. I remember decades ago that during a horrific bear market gold kept rising. Back then it was goldmine stocks that people could own but now one can own the gold itself through the ETF, GLD. GLD is in a weekly RWB up-trend already. (The six red shorter term averages are rising above the blue longer term averages with a white space between them.) If the markets enter a steep dive, the boomers may seek refuge in gold. As may I.