This scan looks for stocks in an up-trend (4wk avg>10wk>30wk) that reached a recent ATH and reached a 20 week high in relative strength and bounced up off of their rising 4 week moving average. If I buy on this setup I exit if the stock looks like it will close the week below the low of the week the setup was triggered. For example, the stocks on this list should not close the week below their last week’s low. The list is sorted by close/lowest price past 250 days. Note the several construction related stocks on the list.

Here is the weekly chart of AAPL as an example. Note the last price bar is green and how AAPL has closed above its 4 wk avg. (red dotted line) every week since March. This is the pattern of a strong advancing stock.

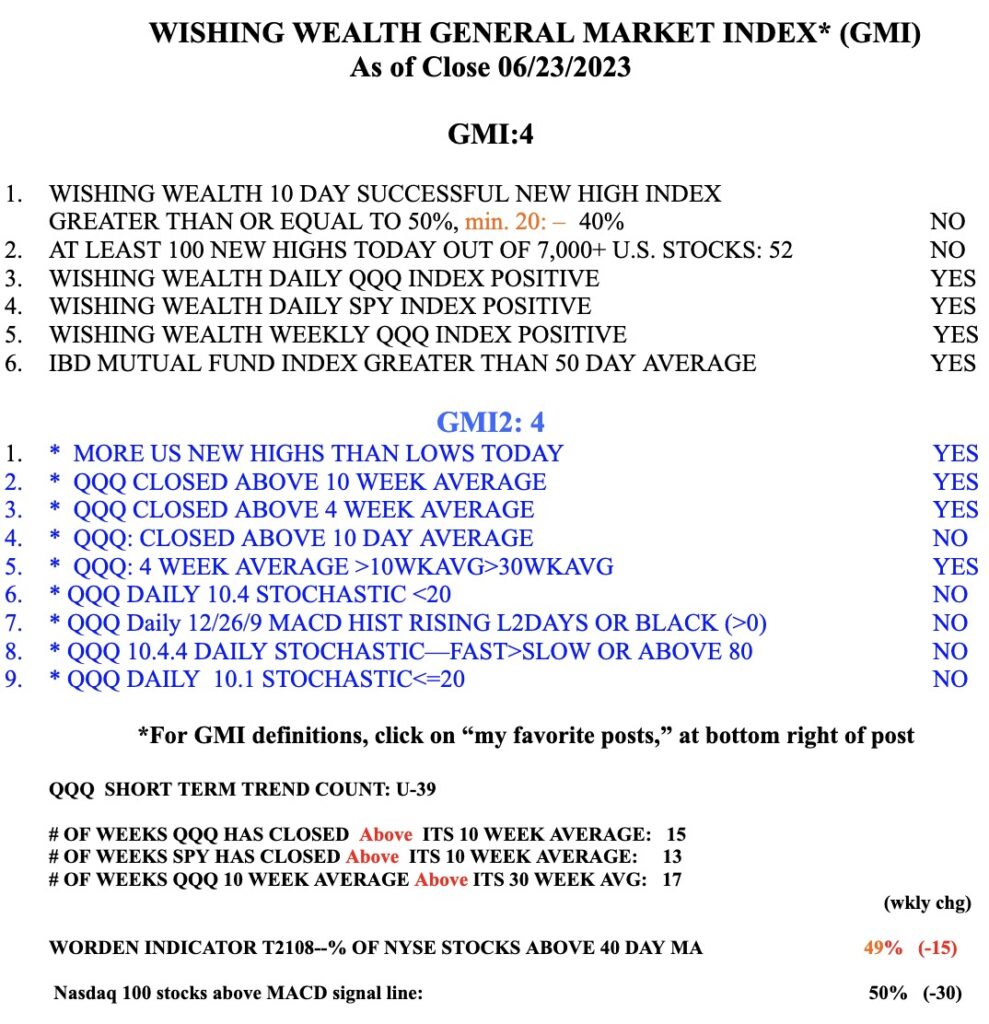

The market weakened last week, as demonstrated by declines in the GMI and GMI2. However, the short and longer term trends of QQQ are still up, for now. This week is the end of the 2nd quarter and we may see strength in strong stocks during this mutual fund window dressing period so that quarterly reports make fund managers appear to be smart stock pickers. The end of quarter reports show portfolio holdings, but do not say when they were purchased or at what price.