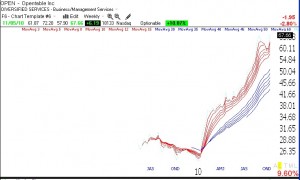

All of my indicators remain positive. OPEN came public in May, 2009 and has already doubled. It is an RWB rocket stock, as the weekly chart below shows.

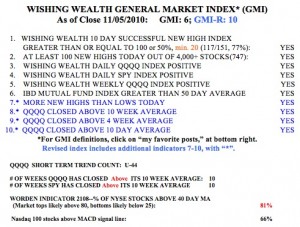

General Market Index (GMI) table

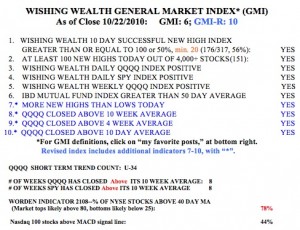

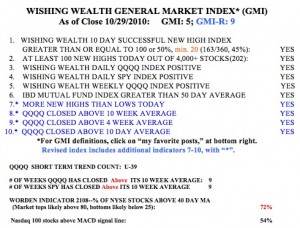

GMI at 5; QQQQ short term up-trend completes 39th day

The GMI remains at 5 (of 6) and the GMI-R at 9 (of 10). I remain long until I get a sign of a down-trend.  The QQQQ has closed above its critical 10 week average for 9 weeks. 54% of the Nasdaq 100 stocks closed Friday with their MACD above its signal line. The Worden T2108 is at 72%. This week Judy will visit my class to present her methods. I hope to create a special column with her picks. Judy is the best stock picker I know.

The QQQQ has closed above its critical 10 week average for 9 weeks. 54% of the Nasdaq 100 stocks closed Friday with their MACD above its signal line. The Worden T2108 is at 72%. This week Judy will visit my class to present her methods. I hope to create a special column with her picks. Judy is the best stock picker I know.