The sudden deterioration in the short term indicators is a little troubling to me. While I am defensive, the longer term weekly up-trends are still intact. Last month, the market weakened considerably early in the month, only to come charging back by options expiration. We do not know whether this pattern will repeat this month. October always brings out the bears. I am trying to hold on to the cash secured put positions I sold. As we get closer to expiration, on 10/16, the time value of the October puts I sold will decay, bring me profits. I am betting that the underlying stocks will not fall so far as to wipe out my profits. Then again, I would not mind having someone put to me shares of AAPL at $170! Meanwhile the GMI

General Market Index (GMI) table

Up-trends intact; waiting for bounce; some rocket stocks to watch

My short and long term indicators are still in up-trends. I am enjoying the current weakness and will wait to buy TYH when it bounces off of support. Support for me for TYH is around 126. If TYH bounces around there I will buy it and place a sell stop below the low of the bounce. Last time TYH bounced, it went from 114 to 138 in about 14 days. TYH is an ultra long 3X tech ETF. My university pension remains 100% long in mutual funds. The GMI

Ultra 3X ETF’s beat individual stocks again!

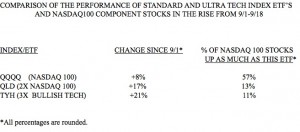

The table below, like the one I showed in late August, shows me the wisdom of forsaking individual stocks in favor of the 2X or 3X ETF”s. Why try to find the few stocks that can beat these ETF’s when the odds are so low? Since the current short bounce began September 1, the standard NASADQ 100 index ETF (QQQQ) rose 8%.  During this same period, the comparable Ultra 2X ETF (QLD) rose 17% and the tech 3x ETH (TYH) rose 21%. If I had been trying to pick the specific NASDAQ 100 stock that would outperform these ETF’s, I would only have had a little better than even chance (57%) of beating the QQQQ. But only 13% of the NASDAQ 100 stocks beat the QLD and 11% beat the TYH. So, why search for the low probability winning stock when I can just buy the Ultra ETF’s? Furthermore, a single stock can be slammed by bad news, but the ETF’s are less vulnerable to that because they represent an index or a collection of stocks. The key to trading profits is to play the odds and not to try to look smart by beating them….. Meanwhile, the GMI and GMI-R remain at their maximum

During this same period, the comparable Ultra 2X ETF (QLD) rose 17% and the tech 3x ETH (TYH) rose 21%. If I had been trying to pick the specific NASDAQ 100 stock that would outperform these ETF’s, I would only have had a little better than even chance (57%) of beating the QQQQ. But only 13% of the NASDAQ 100 stocks beat the QLD and 11% beat the TYH. So, why search for the low probability winning stock when I can just buy the Ultra ETF’s? Furthermore, a single stock can be slammed by bad news, but the ETF’s are less vulnerable to that because they represent an index or a collection of stocks. The key to trading profits is to play the odds and not to try to look smart by beating them….. Meanwhile, the GMI and GMI-R remain at their maximum