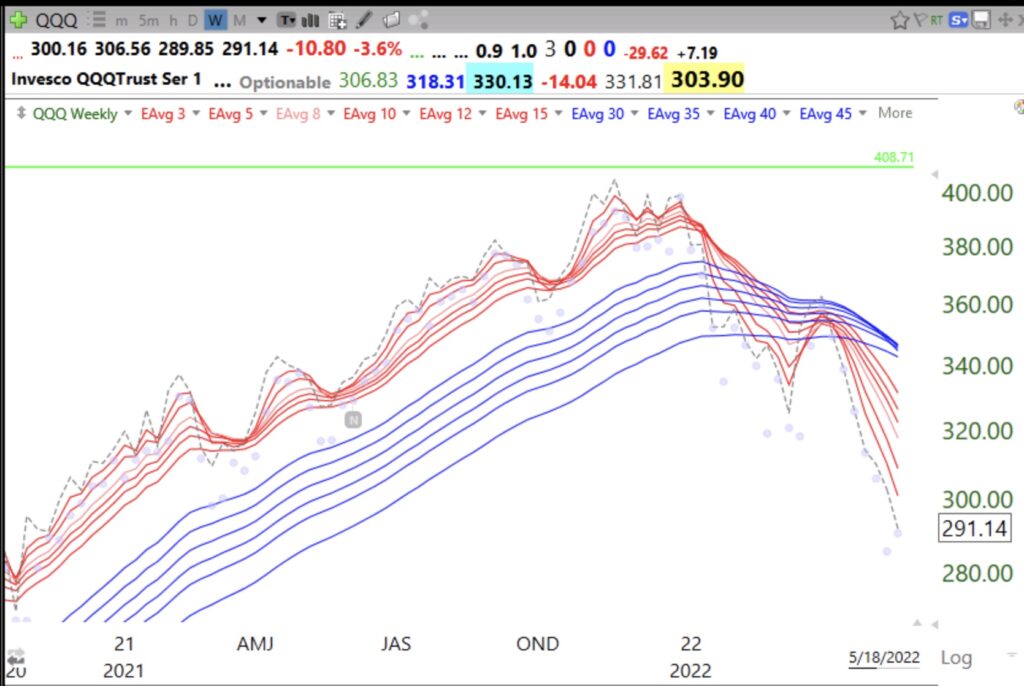

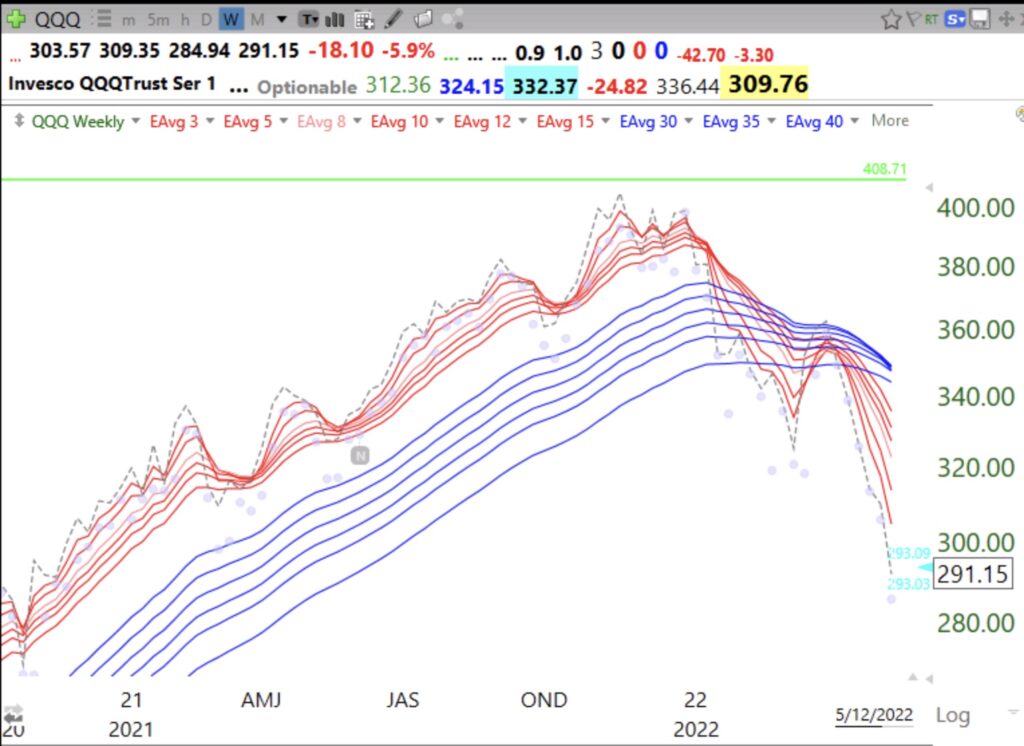

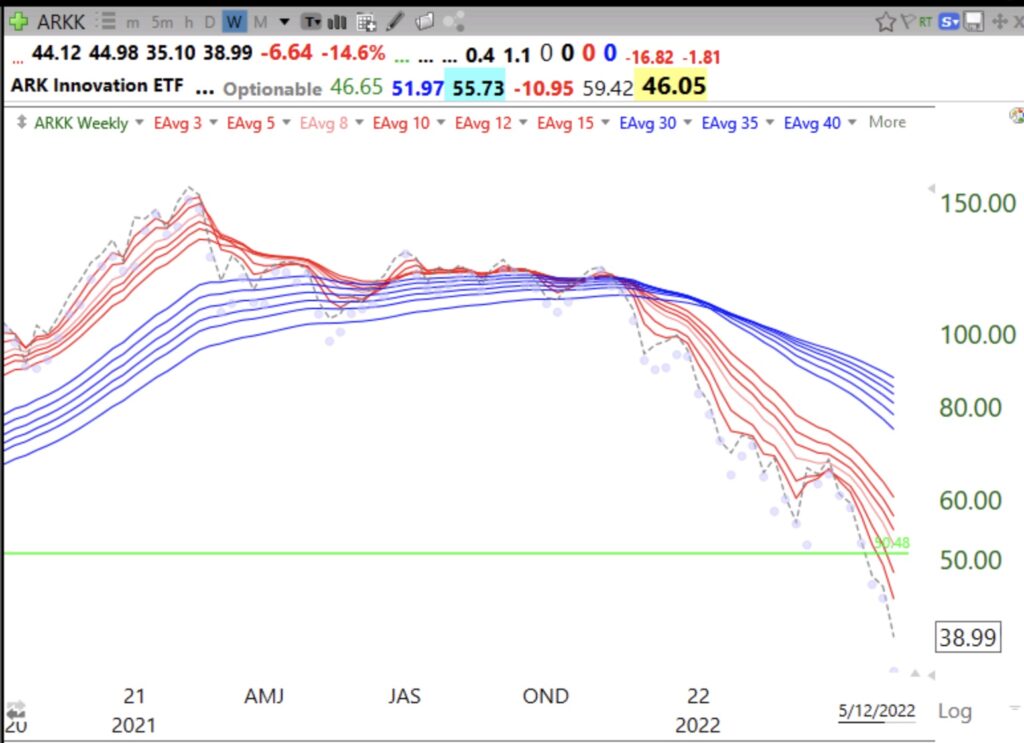

QQQ is now in a weekly BWR down-trend. All shorter term averages (red lines) are declining below the longer term averages (blue lines) with a white space separating them. Note the prior BWR up-trend pattern that lasted from May 2020 until January 2022.

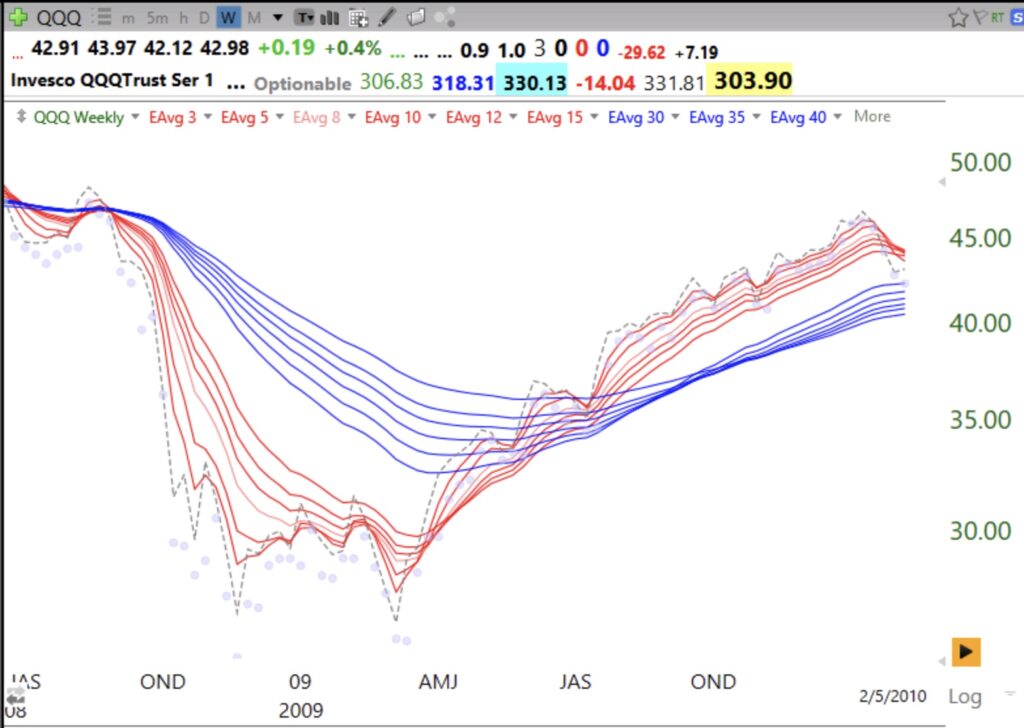

The last time there was such a weekly BWR down-trend was in 2008. See how it ended. The white space disappears and the red and blue lines overlap. You don’t have to get in at the bottom. One strategy is to wait for the BWR pattern to end and really go in when the next RWB up-trend pattern begins. Another is to wait for the weekly closes (dotted line) to rise above all of the red lines and lead them higher. In a down-trend the weekly closes are leading all of the red lines down.