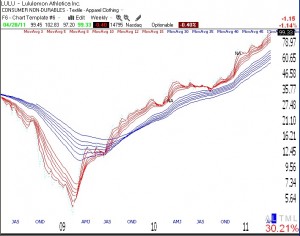

One of my readers keeps writing about his profits in LULU. Note that LULU is an RWB rocket stock and appeared in the New America column in IBD (NA in chart) twice. I wrote about LULU in February when it was around 73. Click on weekly chart to enlarge. While LULU has been strong, its daily stochastic appears to be headed down from overbought territory. I therefore would not buy it today.

20th day of QQQ short term up-trend; TQQQ shines again

All of my indicators remain positive. However, note that the T2108 indicator is at 75%, very close to extreme overbought levels where prior markets have topped out. A reading near 80% would make me more cautious. Since the first day of the short term up-trend in the QQQ on March 30, that index has advanced +3.26%, the QLD, +6.44% and the TQQQ, +9.73%. The TQQQ beat 86% of the Nasdaq 100 stocks. (AAPL was up only +.44% and GOOG was down -7.58%) If I had only jumped on one of these index ETF’s on the first day I identified this up-trend! How many times do I have to learn this lesson?