The QQQQ short term down-trend completed its 7th day on Tuesday. I remain mainly in cash with some short positions. I read a very interesting comment on the current debate on economic policy by David Brooks. I hope you like it. Meanwhile, all of my indicators are negative. It was so easy to make money on the long side when the GMI was 5 or 6 for so long. Now, I must refrain from taking on any long positions. Many key stocks look very weak right now. Time for me to be very defensive.

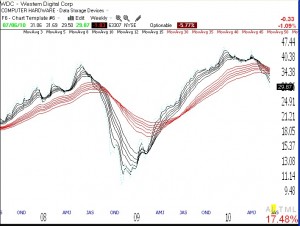

There were 107 stocks that came up in my submarine scan on Tuesday night. Below is one that has come up several times. The GMMA weekly chart for WDC below (click on to enlarge) shows that the short term weekly averages (black lines) are now crossing below the longer term averages (red). As a possible short, it is good to find a stock that was a prior leader (WDC quadrupled in 2009) and peaked about 4-6 months ago. The stock also has a lot of high volume spikes (not shown) on weeks in which the stock declined. These are all properties that might lead me to short a stock like WDC. What do you think? You can email me at: silentknight@wishingwealthblog.com My next Worden webinar is on August 24.

I am positioned mildly long for a bounce.

Would such a bounce shake out your long term short positions?

It would take quite a bounce!

I too am looking for shorts longer term. WDC looks like a good candidate per the charts as do many others. However, the financials and other fundamentals are strong. I will reserve my shorting for companies that have weaker fundamentals including a lot of debt and high P/FCF. Some retailers come to mind but they already have slipped quite a way down. (SHLD,M,PSS).

If what you say is correct, then I did well in moving ALL my pension funds into money market back in MAY 2010 !! I am sitting on the sidelines now.

On May 5th the QQQQ began a short term down-trend that lasted for 29 days. I am limited as to how often I can transfer funds in and out of equity funds so I wait for a change in the longer term before I go to cash. Congratulations on getting out in May, but you missed the short term up-trend in June, that next time could be the real turn. The key is to get out in a decline but also to get back in for the new long term up-trend.