Wednesday was the 32nd day of the current QQQQ short term up-trend. During this up-trend, QQQ has risen 12%, QLD +25.5% and TYH +38%. TYH beat all of the stocks I have been trading, including AAPL +20% and GOOG +31%, yet again showing that riding the 3X ultra tech ETF, TYH, during a QQQQ up-trend beats most individual stocks. The ETF that has risen the most is CZM, China bull 3X, up +45%.

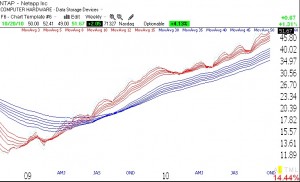

The GMI and GMI-R snapped back to their maximum values on Wednesday. NTAP (weekly chart below, click on to enlarge) is another RWB rocket stock (red short term averages well above blue longer term averages) that hit a 52 week high on Wednesday–I own Dec call options on it. Earnings are due Nov 17. By the way, NTAP is on my cumulative IBD 100/ New America watch list. All of the stocks I buy have therefore already passed the IBD CAN SLIM stringent fundamental and technical criteria.

hi: i’ve followed your comments on this last up move. at which point would you consider that entry into some of these can slim stocks would be chasing. a lot of them move very quickly above their pivot points. they have continued but, at earlier points by o’neil’s criteria, they would have been extended. the rwbs, once the white becomes apparent would make for an extended entry. or am i missing something? thanks

A winner can remain in an RWB for a year or longer. True, we are generally past the ideal O’Neil pivot price when the stock breaks out of a solid cup with handle base. However, there are many subsequent buy points when the stock returns repeatedly to a key moving average. IBD likes support at the 10 week average as a place to get back in. I like that and the 10 day and 30 day averages. I study a stock to find where it is finding support. I then buy off of that support and immediately places a stop below the support level.