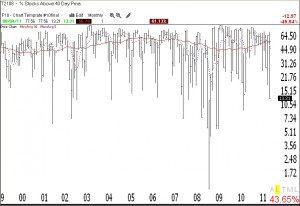

With the GMI and GMI2 at zero, the T2108 is at 13%. In prior extreme declines T2108 has bottomed at <1% (1987) and around 1%. (08) But as this monthly chart shows, declines more often bottom anywhere below 20%. My biggest concern is that investor sentiment polls are not very bearish and pundits are still looking to buy bargains. I remain in cash in my trading accounts.

I would be very interested in hearing whether my posts have helped you weather this decline.