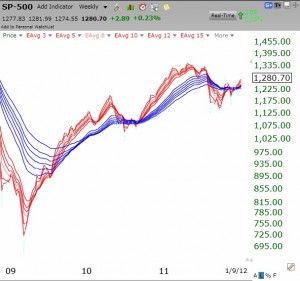

Up-trend continues. The GMI buy signal of December 23rd is still in place. Since 12/23, the QQQ has advanced +3.7%, the QLD by +7.5% and the TYH by +9.1%. AAPL has risen +4.8%. Among the S%P 500 stocks, only 15% have risen 7% or more. In an up-trend it still works better to just buy the leveraged ETF than to search for the minority of stocks that will outperform it.

Month: January 2012

Sentiment figures reaching extremely bullish levels

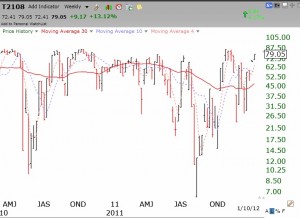

I monitor the Worden T2108 Indicator and the Investors Intelligence poll to assess if the market has reached an extreme level of bearishness or bullishness. The T2108 closed Tuesday at 79%. This is close to the level where prior market rallies have topped out. Similarly, far more advisers are bullish than bearish (49.5% vs. 30.5%). This is a contrary indicator. The market is likely to top out when there are many more bulls than bears. The weekly chart below demonstrates that at 79%, the T2108 is near its peak level. Click on chart to enlarge.

The sentiment indicators suggest to me that I need to raise stops or hedge my long positions in my trading account so I do not lose all of my recently generated gains.