On December 23rd, the GMI flashed a buy signal.  I remain invested long in my university pension and hold several long positions in my trading accounts. AAPL has helped to drive the Nasdaq 100 index (QQQ) higher. GLD may be reaching the end of its rebound from oversold levels. With its stochastic at 89, I am looking for signs of a reversal before I short GLD.

I remain invested long in my university pension and hold several long positions in my trading accounts. AAPL has helped to drive the Nasdaq 100 index (QQQ) higher. GLD may be reaching the end of its rebound from oversold levels. With its stochastic at 89, I am looking for signs of a reversal before I short GLD.

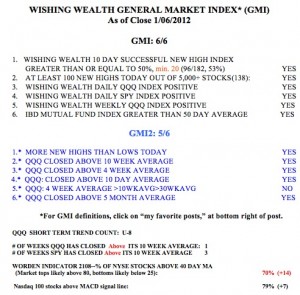

Month: January 2012

7th day of QQQ short term up-trend; ASPS and NGLS

This up-turn looks like it has legs. I am accumulating some QLD, given that the GMI gave a buy signal on December 23. AAPL is coming back and helping the QQQ to rise. ASPS faked a high volume down-side break, as it recovered strongly on Thursday. If it can break above its top Bollinger Band and recent peak of 50.82, it may have a ways to go. I added to ASPS on Thursday. I also own NGLS, a natural gas stock which is showing signs of strength and is near its all-time high. See the weekly chart below.

6th day of QQQ short term up-trend; ASPS falters

The up-trend continues. Four stocks came up in my new high and good fundamentals scan: ISRG, ARG, WPZ, DXPE.

Not all stocks did well on Wednesday. After about 10 weeks of a rise, ASPS finally weakened. Note the high volume break below the narrow Bollinger Band consolidation. Click on daily chart to enlarge. The stock has now closed below its critical 30 day average (red line) for the first time since October.