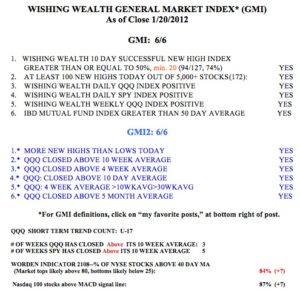

GMI and GMI-2 remain at 6 (of 6). While the Worden T2108 is high, at 84%, this up-trend still looks strong. I am 100% invested in mutual funds in my university pension. My trading accounts hold long positions. I am gradually accumulating index ETF’s. The GMI buy signal has been in place since December 23rd. Since that day, the QQQ has advanced +6.6%, the QLD is up +13.5% and the TYH is up +19.5%.