I am more confident of this new QQQ short term up-trend now that it has reached the 5th day. There were 262 new 52 week highs on Tuesday. The GMI flashed a buy signal on December 23 and remains in place. Only 1 stock passed my new high with great fundamentals scan, CMG. However, CMG reversed down on Tuesday after meeting resistance at its top Bollinger band. Three stocks came up on my Rocket Scan that were also on my IBD50/IBD NewAmerica watchlists from the past year or so: LQDT,PSMT,JAZZ.

Month: January 2012

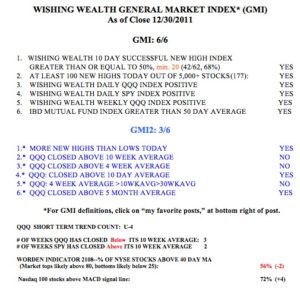

GMI at 6; WishingWealth GMI rocks; Gold in decline

The GMI remains at 6 and there is still a bullish signal in place. I reviewed the performance of the GMI during this break and found it to have performed quite well since I began posting it in 2006.  I will eventually publish the findings. For now, I will just say that the WishingWealth General Market Index (GMI) handily beat a buy and hold approach while reducing risk by keeping me out of the market during the major declines in this period. I will present the data and the key decision rules that I used, in my presentation at the Worden 2012 Conference in DC in April.

I will eventually publish the findings. For now, I will just say that the WishingWealth General Market Index (GMI) handily beat a buy and hold approach while reducing risk by keeping me out of the market during the major declines in this period. I will present the data and the key decision rules that I used, in my presentation at the Worden 2012 Conference in DC in April.

Meanwhile, the QQQ short term up-trend has now reached 4 days (U-4). Nevertheless, the QQQ has closed below its critical 10 week average for 3 weeks. In contrast, the SPY has closed above its 10 week average for 2 weeks. So, the large cap index has been outperforming the tech stocks, for now. The Worden T2108 indicator is at 56%, in neutral territory, and 72% of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. However, the daily stochastic for the QQQ is nearing the overbought range and I think this two week rebound from oversold may be coming to an end. With the GMI-2 at 3, I remain cautious now with only a few hedged long positions. My university pension still remains invested in mutual funds, for now.

If you want to see why I am bearish on gold, take a look at this daily GMMA chart of GLD.

(Click on chart to enlarge.) Note that the short term averages (red) are far below the longer term averages (blue). Prior recent support levels have been broken. The multi-year up-trend has likely ended and I own a put option on GLD.