The Dark Liquidity site has been comparing the GMI based trading strategy versus a number of other strategies. For each of the last two years a strategy that bought the QLD whenever the GMI signaled buy, and went to cash every time it signaled sell beat all other strategies followed. In 2012 the GMI based QLD strategy was up about +30% and thus far in 2013 it is up +42%. I do not check that site’s computations, but my experience is that repeatedly, buying QLD when the GMI signals buy has usually worked. Since the last GMI buy signal on September 4, the QQQ is up 9.3%, the SPY is up +8.5% and the QLD is up 19.5%. For those willing to trade TQQQ, the speculative 3X leveraged QQQ bullish ETF, it is up +29.9% in the same period. While past performance does not guarantee future results, it is striking to me that I have found and posted similar results for prior up-trends signaled by the GMI.

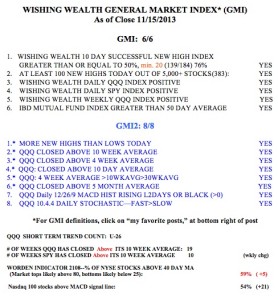

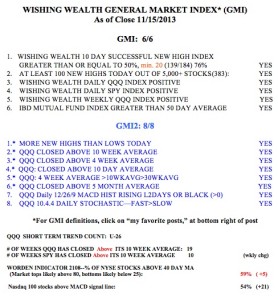

With that as an introduction, here is the current GMI and its components. After a down-trend, two days with the GMI above 3 signals a buy and two days below 3 signals a sell. I continue to post the GMI signals to the right of this site. I would be interested in hearing from my readers whether they have been able to trade successfully based on the GMI.

For those following ONVO, it had its highest trading volume ever, 26 million shares, on Friday. With the stock going near vertical, it is very dangerous. But it did burst through its green line top! When I first posted about it when it was around $4, I warned that it was like buying a lottery ticket. It still is…..