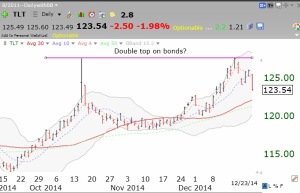

Last post I explained why bonds fall in value when interest rates rise. What I neglected to add was that with interest rates having declined so much over the past few years since the 2008 debacle, a lot of people who invested in bonds saw their bonds increase in value. Many of these people will likely flee their bonds if (when?) rates start to reverse up. People who became accustomed to merely holding bonds and watching them rise in value may be in for a large shock when they plummet. After the turn when rates rise enough to be attractive, people will exit risky stocks in favor of more conservative bonds or CDs, precipitating a bear market in stocks. For example, if the day ever returns that I could nail down 6% annual interest in insured CDs, I and many other boomers would presumably be happy to get out of stocks and park our money in interest bearing instruments after retirement. It is for this reason that I need to be very vigilant for the first signs that interest rates are reversing up….

Mr Market tends to seduce people into the stock market so that the most persons get hurt at some point. I am noticing more and more articles by the media pundits saying that people should just buy index ETF’s. Why try to beat the market when most professionals fail? Along with this advice is the idea not to try to time the market. Just buy the index ETF and don’t even peek at it. What could happen to make this advice hurt the most people? What if the entire market as reflected in these index ETFs or mutual funds declined 30% or more in a short period of time? Would these investors who swore off market timing throw in the towel and panic at the exact bottom? I think so. The boomers who put their faith in index funds will look at the impact of a declining market on their retirement finances and run for the exits. I think we fail to acknowledge the huge negative reaction that boomers will have to the next large stock market decline.

Using many of the components I put into the GMI, and my experience in the markets since the 1960’s, I exited the markets during the major 2000-2002 and 2008 market declines. I then reinvested after the dust had settled. Today I am that much closer to retirement and refuse to hold an index fund through the next big market decline. I cannot afford (emotionally or financially) to wait even 3 years for the market and my account balances to recover. So I disagree with all of these “buy and hold index funds (or ETFs)” adherents. Maybe they do not depend mainly on their 401(k)s and IRAs to fund their retirements (hint: that is why they sell their advice)….

I do not know when the market will turn down (no one does). I do know that when it turns it will be quick and massive as the boomers head for the exits. I will monitor my GMI for the early signs and remain a chicken, willing to exit early rather than late.