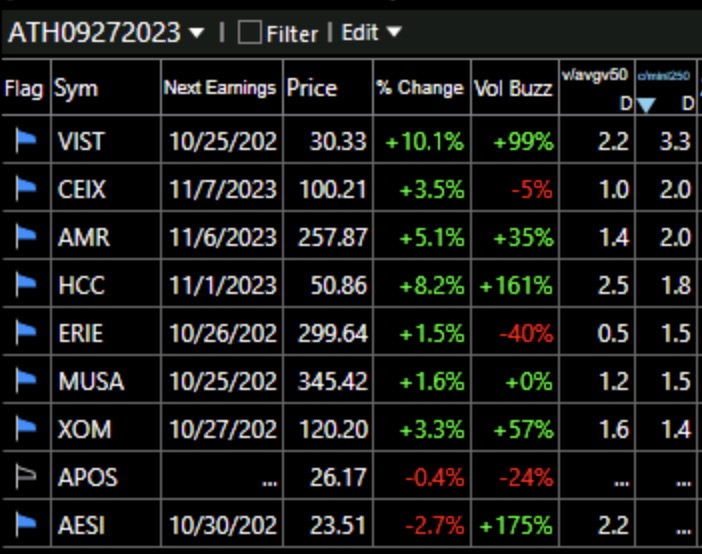

It is pretty persuasive when many of the stocks doing well come from the same industry. Here is the list of 9, sorted by Wednesday’s close/lowest price the past year. Two of them ( APOS and AESI) are IPOs within the past year and have a “…” result. Coal is hot! Even XOM made the list!

The QQQ short term trend seems to change with two consecutive closses above or below the 30 day simple moving average. For the last 20 years backtest shows this results in one third of the total return of buy and hold and about one half the drawdown. Using a 30 day moving average and a 2 day moving average crossover works a little better.

To Dr. Wish’s credit he seems to want to help folks and is not trying to sell much. But for most people following his short term QQQ signals or GMI will greatly hurt their returns by being out of the market. All of his timing signals do reduce drawdown but dramatically lower total returns. Why are there no clear results comparing his timing models to simple buy and hold for 5,10,15 years?

No serious trader is making money like this. Dr. Wish is an academic and likely made his money through salary and not through trading. Once you have acquired money, using timing like this can reduce risk but it will severely slow overall growth.