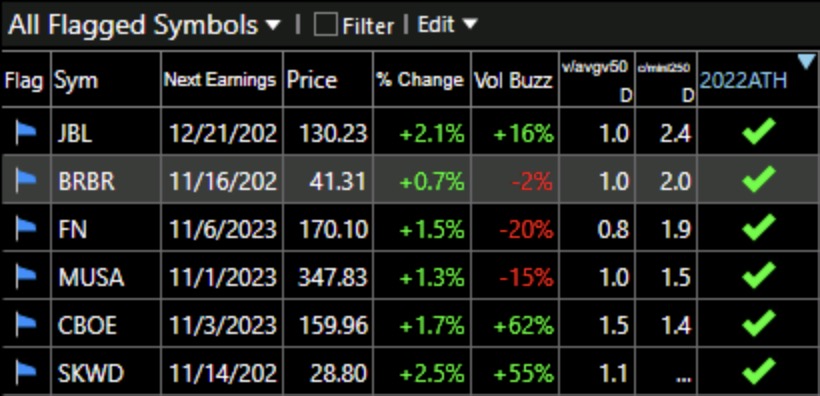

The unusually high put/call ratio, the low T2108 value, plus the fact that earnings are coming next week suggest to me that we are about to experience a meaningful bounce. 89% of the Nasdaq 100 stocks rose on Wednesday, the highest percentage since August 29 (91%). These 6 stocks on my IBD/MS recent watchlist hit an ATH on Wednesday. They are sorted by price/lowest price last 250 days. SKWD has no value (…) because it is a recent IPO. See its promising weekly chart below.

Possibility of major dump also. The 200 day MA is a potential magnet here. It would serve the whales to reverse the trade after retail piles in. https://schrts.co/JvdfEbTV