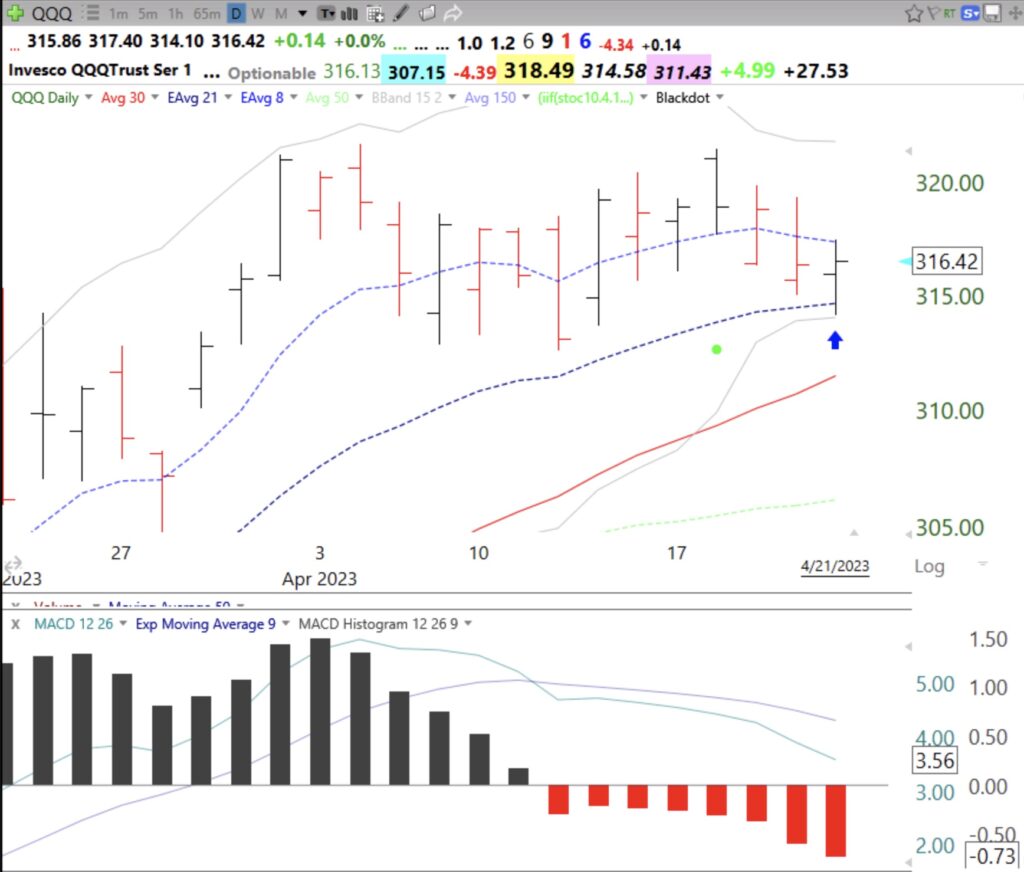

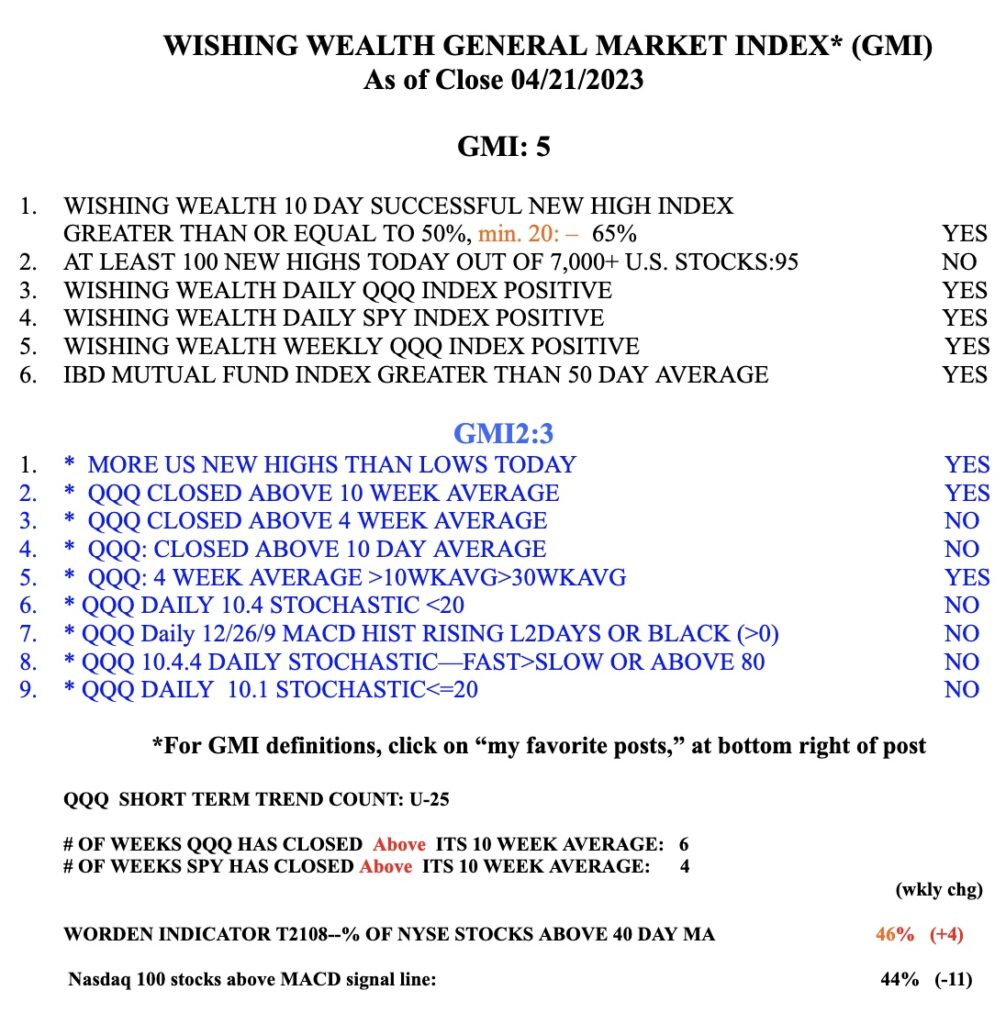

Equities mostly stay within their upper and lower Bollinger Bands. I use the 15.2 BB. When the bands contract it indicates reducing volatility. At some point the stock breaks out of the constricted bands and volatility explodes. The problem is one does not know in advance which direction it will go. On Friday, QQQ bounced up off of the lower band, see arrow on daily chart. The MACD histogram pattern is another useful indicator for gauging the likely direction and strength of a move. This daily chart shows the 12/26/9 MACD histogram bars being red (negative values) for 8 days, revealing weakness. This means the MACD is declining below its signal line, also shown on this chart. I also remain very cautious because the Sell in May period is imminent. I think there will be a huge debt limit debacle in June or July. Few market pundits are talking about it, which worries me. I went back and reviewed what ETFs rose during the 2011 debt stand off when S&P lowered the US treasury ratings. I found that gold and US treasuries rose. I am therefore holding some UGL and TLM. Both are 3x leveraged ETFs for gold or 20 year treasuries, respectively. I may be too early on this but I am watching these ETFs closely for signs of life. The GMI, shown below, remains Green at 5 (of 6) but the very sensitive indicators in the GMI2 are weak. Be careful.

General Market Index (GMI) table

Blog Post: Day 20 of $QQQ short term up-trend; 18 stocks on my IBD/MS growth stock list reached an ATH on Friday, see list

These stocks are sorted according to current price divided by lowest price the past 250 days. Seven are 2x or more their lowest price the past year. Doublers are worth studying to see if they meet one’s set-up for a low risk purchase. Be sure to note the next earnings report date for each, in column 3. The greatest winning stocks break out to an ATH and then go on to a series of ATHs over many months. Why buy the fallen angels when there are some new ones rocketing to historic heights?

The GMI remains Green. So many people are chasing income instead of growth stocks these days. The crowd is usually wrong and will get back into stocks long after the market has advanced. I noticed for many years that the media proclaimed a bull market about 6 months after the bear market bottom was in.

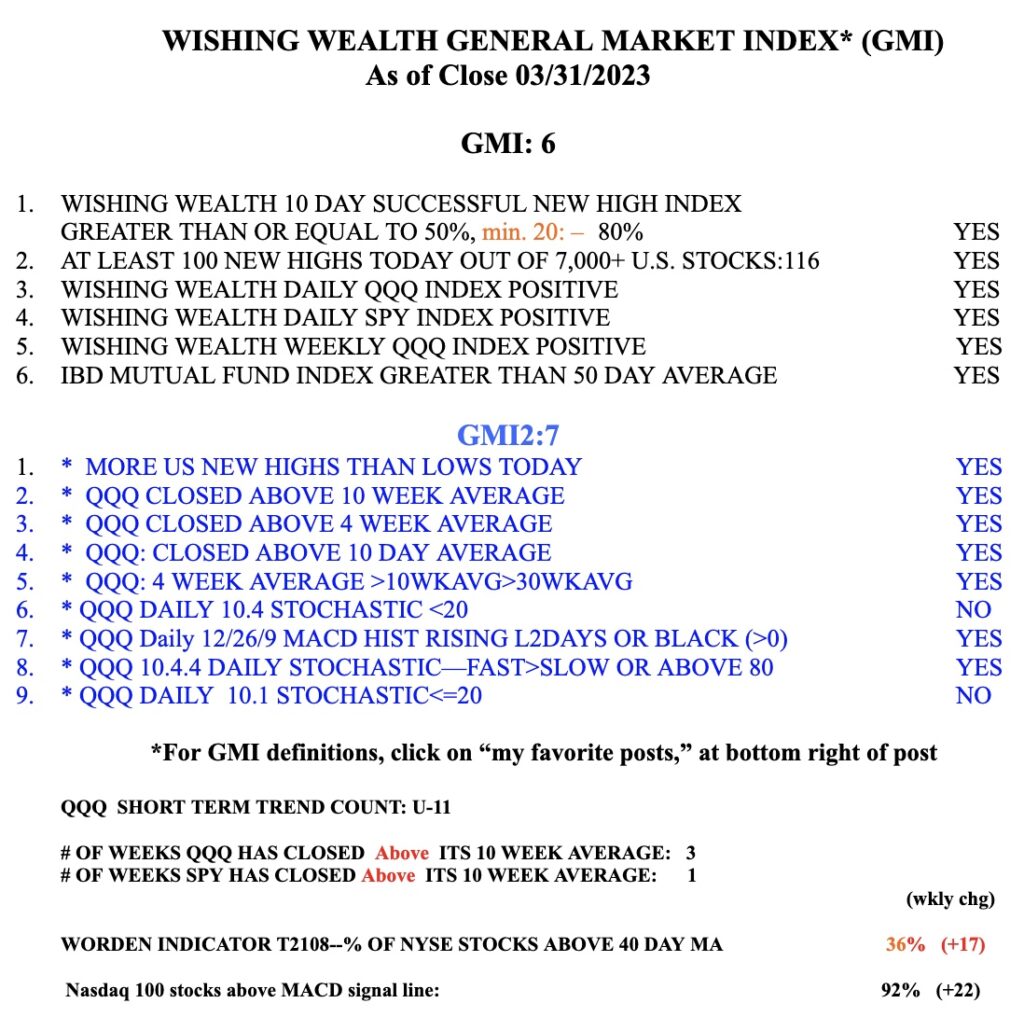

Blog Post: Day 11 of $QQQ short term up-trend; GMI= 6 (of 6); Time to abandon low risk income and buy stocks/ETFs; Mutual fund window dressing is over, on to earnings, see list of 18 growth stocks at ATHs

Everyone is talking about hiding in safer FDIC insured money market accounts now that one can earn 4%+ in interest, risk free. I told you in November, 2021 that I was exiting the market because the Fed would raise interest rates and that would suck the $$$ out of stocks. Now get ready for the reverse. We are closer to a decline in rates and that will eventually cause money managers and the public to return to stocks again. It really is that simple. The Fed tightens too much and then slashes rates to get the economy going again. Read the late Martin Zweig’s classic book.

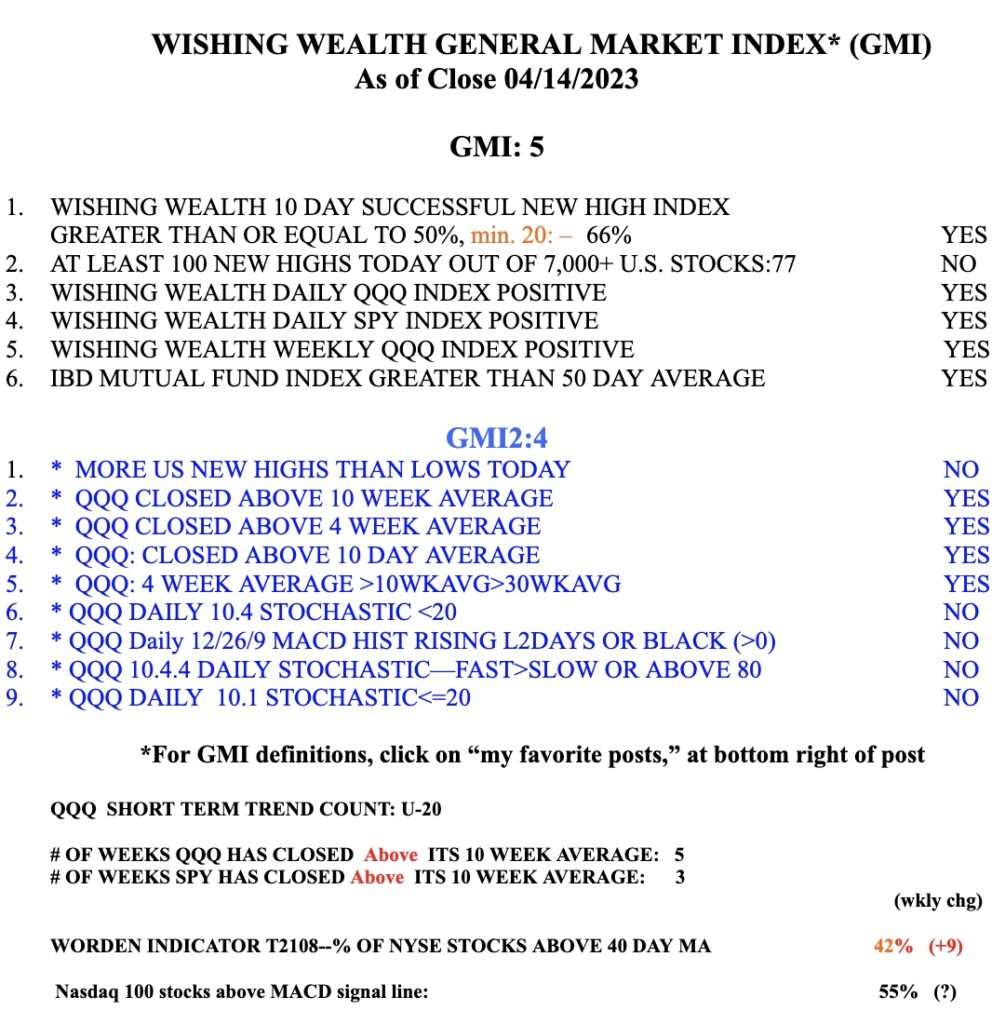

In addition, my GMI (see table below) has now gone to the maximum value of 6. I protected myself from the 2022 decline and am now ready to move back into equities. In my university pension I have begun to transfer out of money market funds and back into mutual funds. In my trading IRA I will begin to buy ETFs and a few growth stocks. I only buy stocks that are above their last green line and trading near their ATHs. The great winners bought by Darvas and O’Neil were stocks going to ATHs. I do now want to buy fallen angels that are turning up or building bases. If they can make it back to ATHs I will consider them. Any stock that can come through 2022 at an ATH is showing incredible relative strength and proof of buying by the big boys. On Friday, there were 18 stocks on my watchlist of stocks recently appearing on IBD/MS lists that traded at ATHs. (I omit cheap or low volume stocks.) This list contains possible market leaders and bears (bulls) watching. (I own some.)

The list is sorted by the last column, Friday’s closing price divided by their lowest price during the past 250 days. Thus, ELF has the highest value of 4.0. Any stock that is hitting an ATH and is trading 4x higher than its yearly low is worth considering. So is INTA, at 3.3x, a recent IBD New America stock, which I wrote about last week. Remember, both Nicolas Darvas and O’Neil’s protege, David Ryan, preferred buying stocks that have already doubled. I want to jump on rockets that have been launched and are heading to the moon, not those close to the earth. Note also the next earnings date column for each stock.

Last week was the end of the quarter when mutual funds dress up their portfolios with the strongest performing stocks. Their end of quarter reports will then show them owning the winners, but do not state when they purchased them. So they look like smart investors to persons reviewing their fund.That is one reason why growth stocks did so well last week. With earnings season coming up we are likely to see more advances. However, remember we are also approaching the Sell in May period which will coincide with the debt ceiling battle. There may be an opportunity to increase positions during this summer’s hysteria. For now, I am following my market indicators. See the GMI table below.