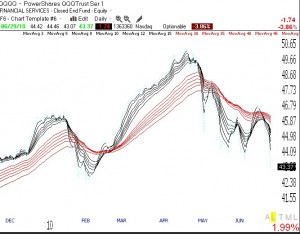

The GMI kept me out of this market decline. Both the GMI and the GMI-R are at zero. I will wait for the GMI to get back to 3 before I will even consider going long again. Meanwhile, my account rose on Tuesday, as I held some TYP and some put options. I have been writing that GOOG looked weak, and it fell 3.77% (-17.82) on Tuesday. The pundits blame various news events on Tuesday for the decline. We know, however, that this down-trend was in existence before Tuesday. The market telegraphs its trend, if one is willing to listen to and follow it. Check out the daily GMMA chart below (click on to enlarge) and note that the short term averages (black lines) are declining well below the falling longer term averages (red). The time to be long is when the short term averages are back above the long term averages and both are rising, as was the case from February through April.

Your GMI is right on. Excellent work.

Are the moving averages on the Guppy simple or exponential?

What moving averages do you use?

The moving averages in the GMMA are exponential. Their lengths appear at the top of the chart. Click on the chart to enlarge. The last ones cut off from view are 45, 50, 60.

How does your assessment of the current market decline affect your investment strategy for the mutual funds in your university pension plan? What factors would prompt you to change these mutual fund investments?

Great question. I should have exited to money market last week, but feared being penalized for market timing. Now I have to figure out when to lighten up. At least I went to cash/short in my IRA.

Take a look at the T2108 using the guppy MMA. Very interesting chart.

I have been reading your blog and market commentary daily and appreciate your sharing of knowledge with us.

I have a question regarding market timing. Did you buy TYP and put options on 6/29 on the day of big gap down or earlier? The reason I am asking is that it appeared on 6/29 that market is oversold with already down 5 days in a row and it would be risky to short the market as it could bounce. I am trying to learn your methods as they suit me in terms of timeframe and day job I have to maintain. Thanks and appreciate your feedback.