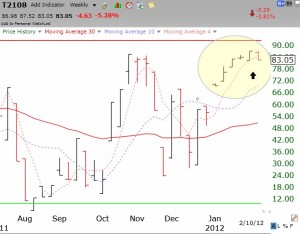

I do not like to try to predict the market. It is as feasible as accurately predicting the number of votes someone will get in a primary/caucus! However, it is good to look at certain indicators to see where we may be in a move. The Worden T2108 indicator acts as a pendulum of market buying and selling. It measures the percentage of NYSE stocks that closed above their average price of the past 40 days. T2108 rarely breaks above 90% on the up-side and anytime it gets into single digits it has been a good time to pile into at least index ETF’s. While T2108 has been in the high 80’s the past week, for the first time in six weeks (see yellow circle in weekly chart of T2108), its value has declined from the prior week. (88% to 83%). A week-to-week decline from this high level often foreshadows a multi-week decline. Such a decline would be consistent with the post-earnings period lull that often occurs until stocks rise again in anticipation of the next quarter’s earnings releases. Thus, we could see some consolidation through the end of March. Maybe this scenario will not develop, but for me, I am inclined to raise stops and defer new purchases for now.

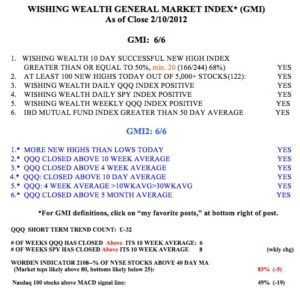

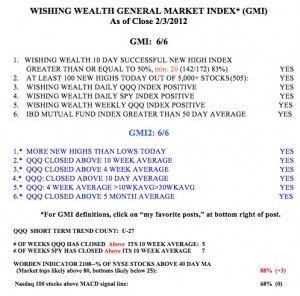

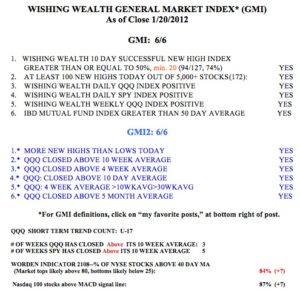

Meanwhile, the GMI remains at 6 (of 6), reflecting that the short and longer term trends remain up. One sign of weakness in the GMI table is that the percentage of Nasdaq 100 stocks with their MACD above its signal line has fallen from 68% to 49% week over week. This can be a sign of short term weakness in tech stocks. Friday was the 32nd day of the current short term up-trend in the QQQ.