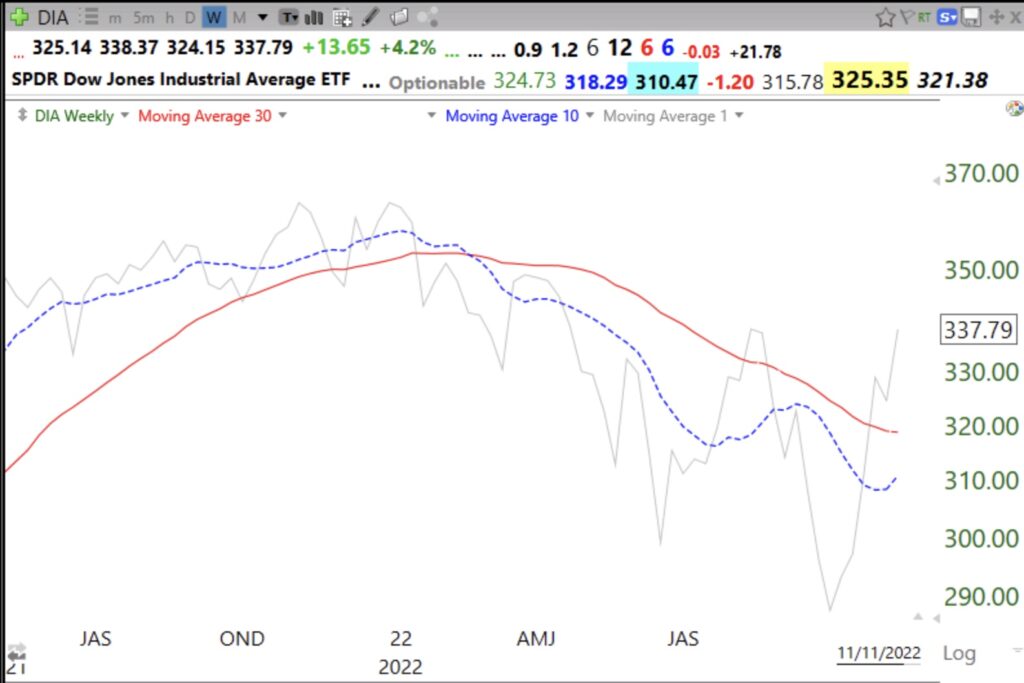

The 4 wk avg is the pink dotted line and the 30 wk avg is the red solid line. Note that last week QQQ was sandwiched in between these two averages. The rising 4 wk avg above the 10 wk avg (purple dotted line) is a positive sign. A close this week above the 30 week could be a further sign of strength, although such a pattern failed to hold last August. On the other hand, a close below the 4 wk would suggest further weakness to come. Stay tuned…..

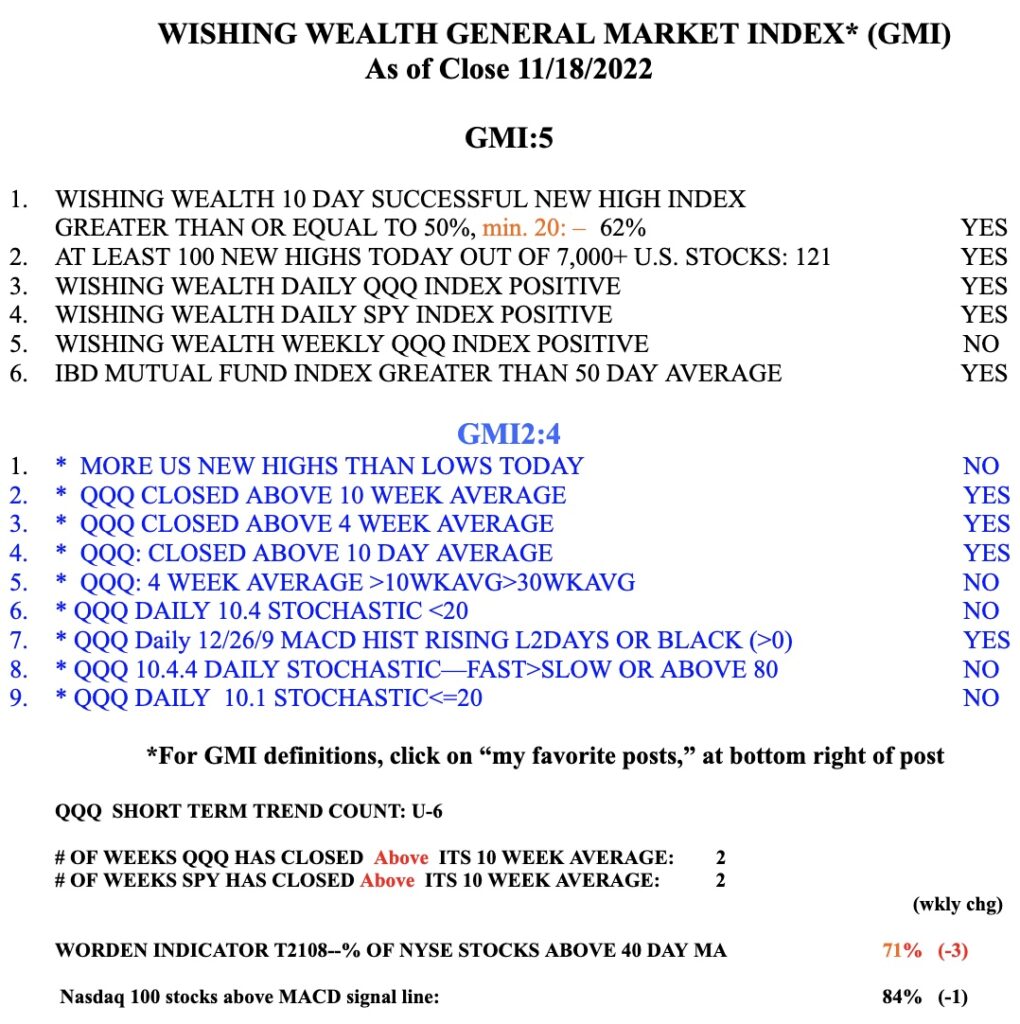

The GMI registers 5, of 6, and remains on a Green signal.