We are now into the earnings season bounce. Many stocks hit ATHs on Friday. Here are the 16 ATHS on my IBD/MS watch list, sorted by earnings please date. The following subset had a GLB (green line break-out to ATH after a minimum 3 month consolidation) last week: TRV, CAT, CB, IRDM, LW. This list may contain some new market leaders.

These 11 are not on that watchlist but also hit an ATH:

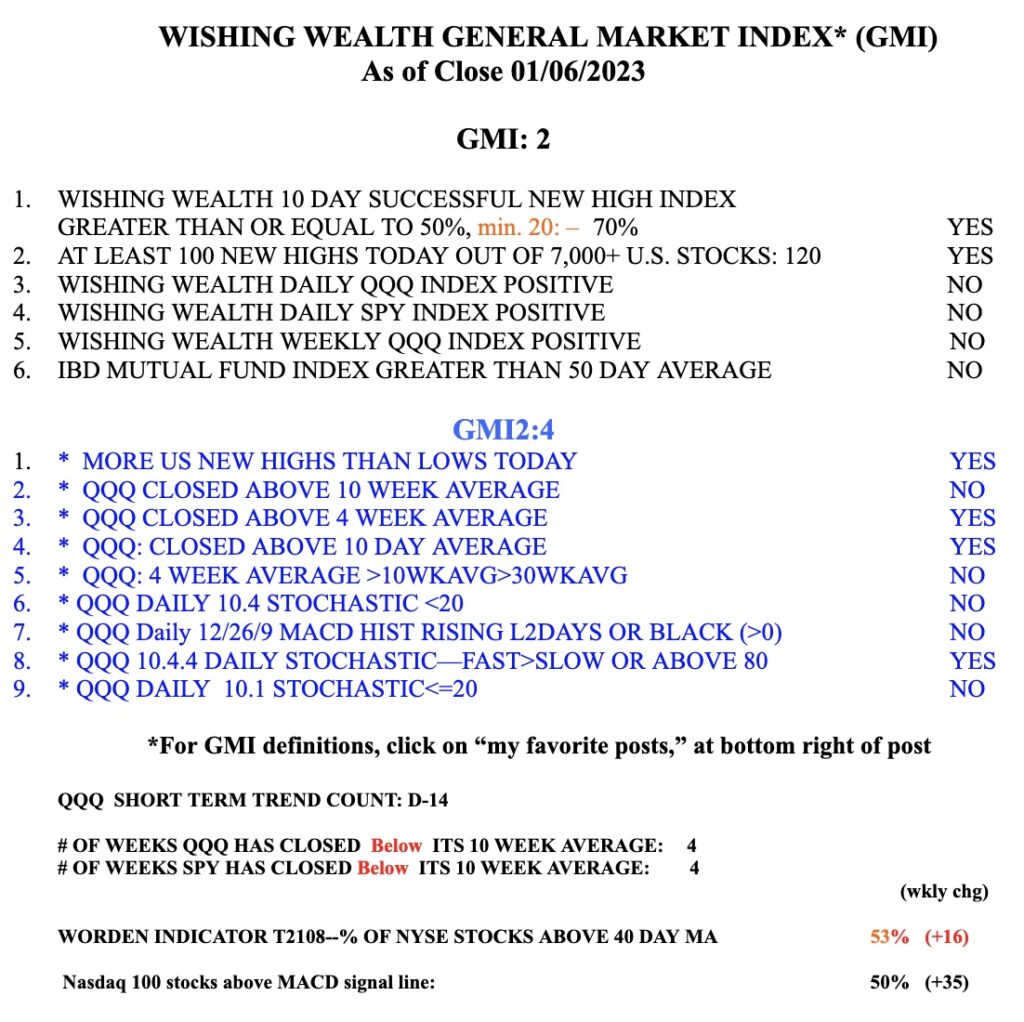

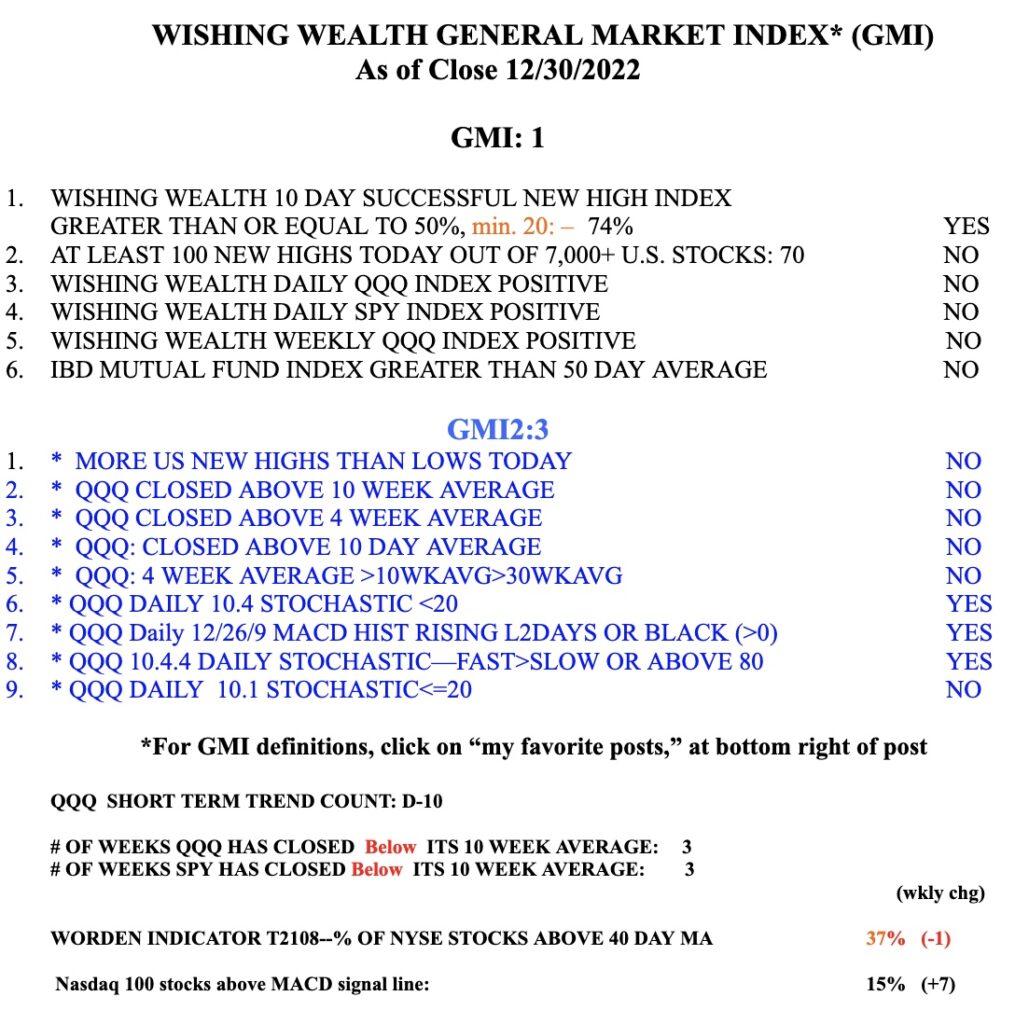

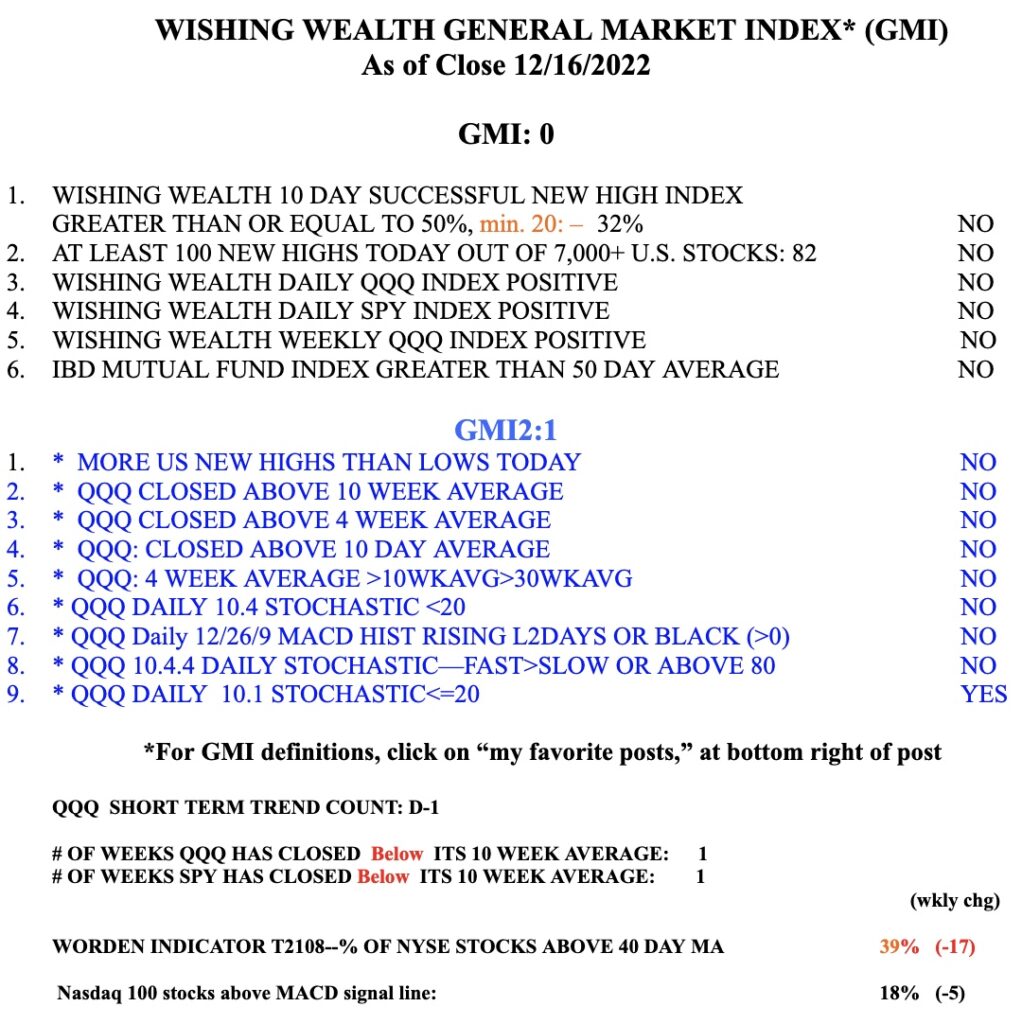

The GMI = 2 (of 6) and remains on a Red signal but IBD has called a new confirmed market up-trend.