These are worth researching. They all reached an ATH in the past 10 weeks, have a weekly 10.4 stochastics>=80 for at least the past 10 consecutive weeks and come from my watchlist of IBD/MS stocks. The list is sorted by current price/price 250 days ago.

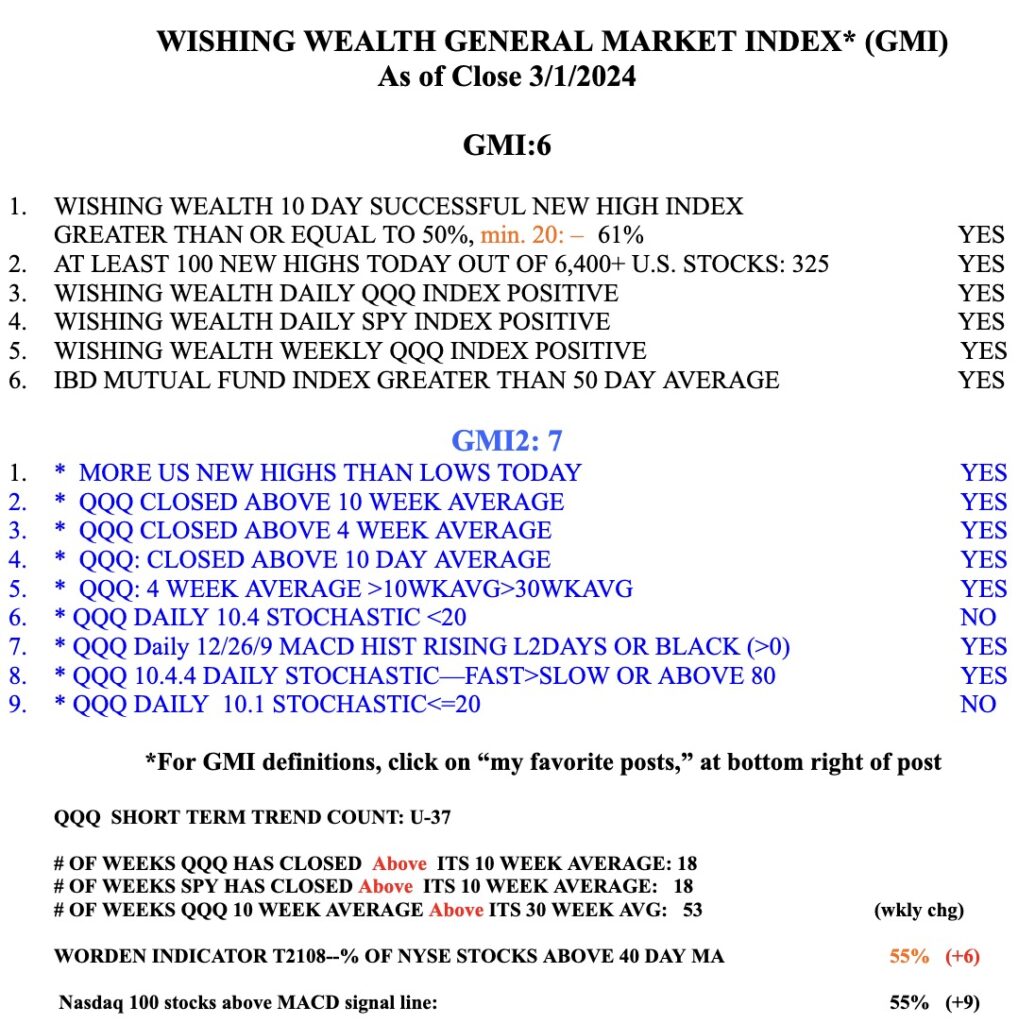

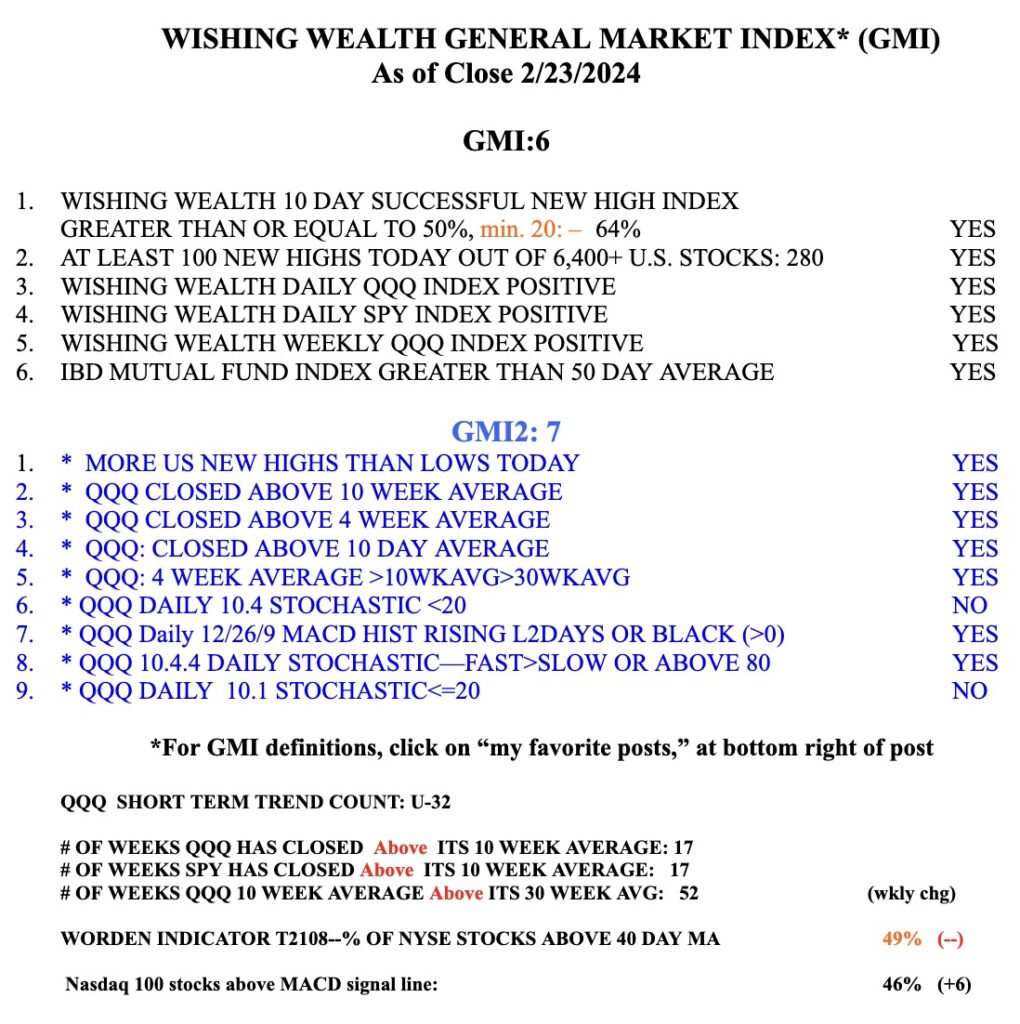

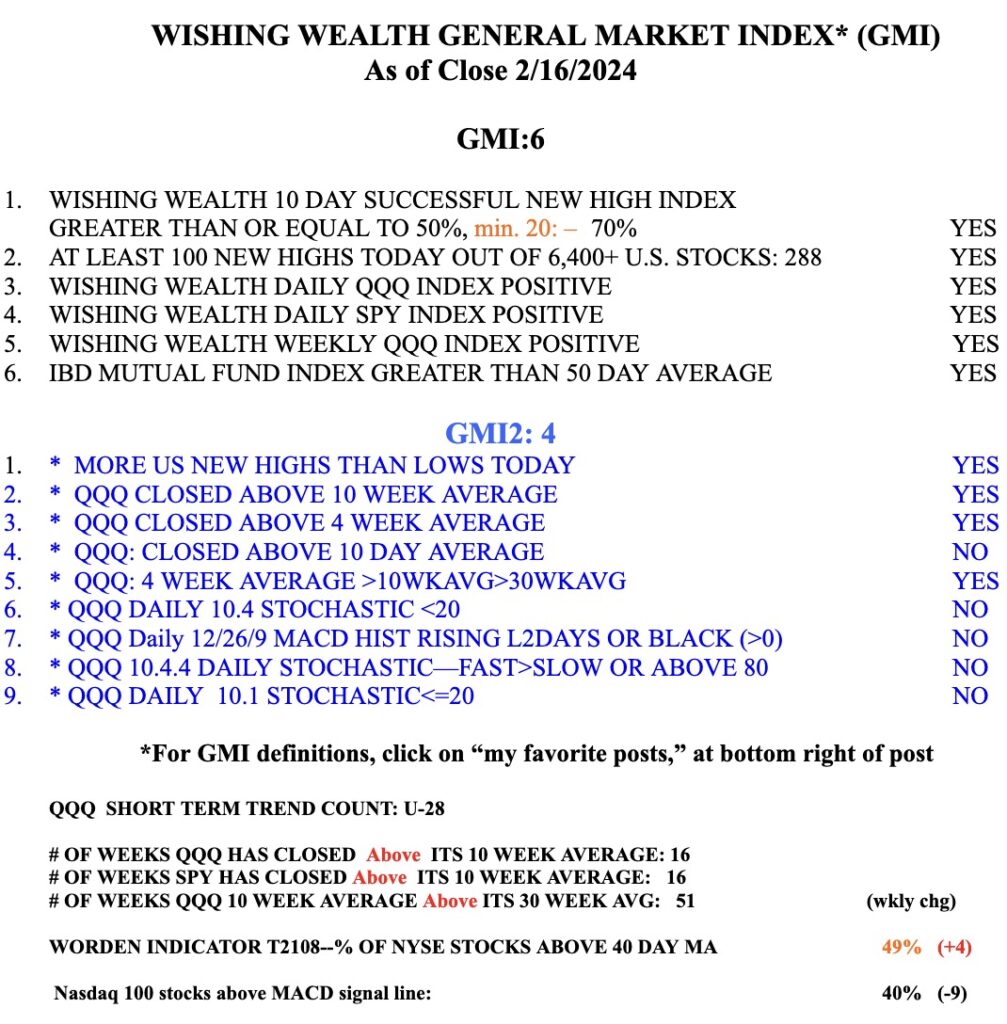

The GMI is Green and registers 6 (of 6).