One of the few GLB stocks which I wrote about in December , KL, is successful and continues to climb.

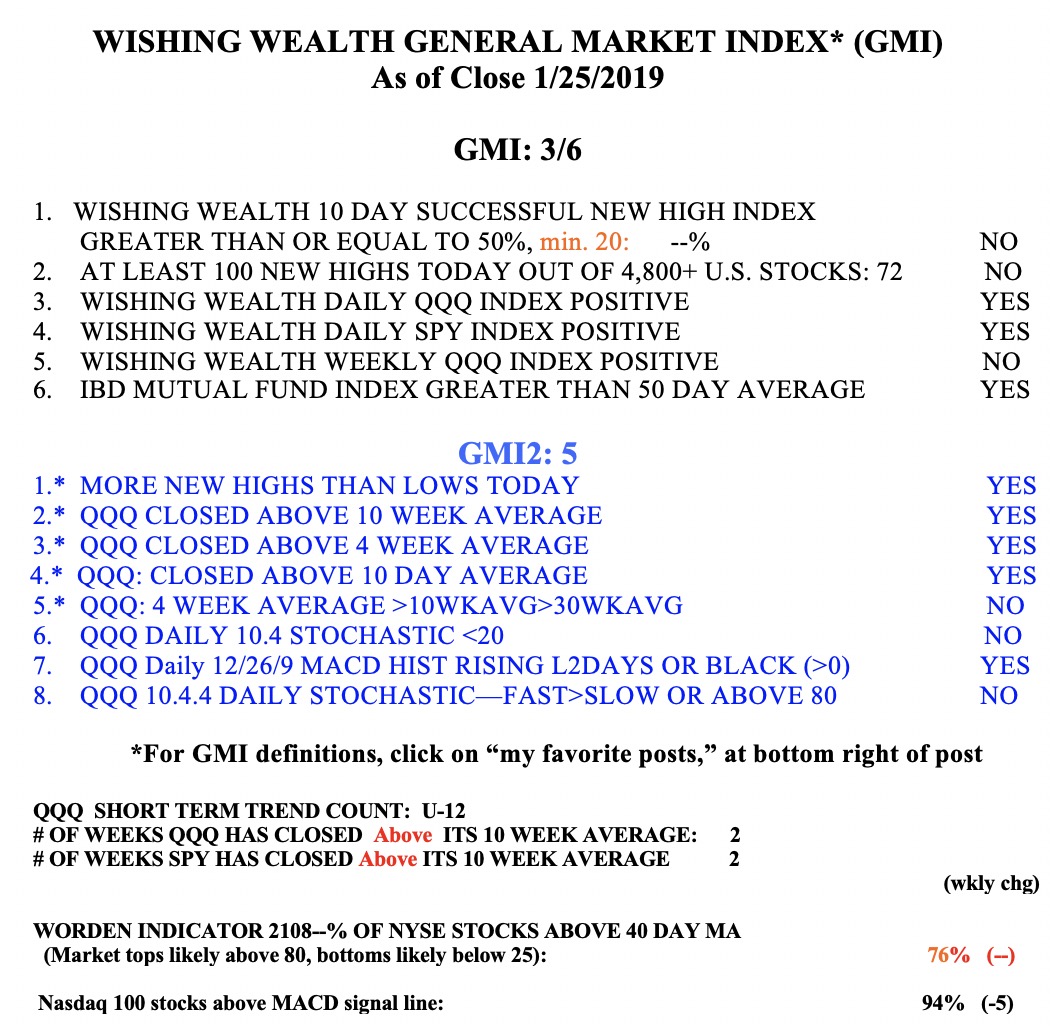

The GMI remains at 3 (of 6) and on a Red signal. 72 new highs on Friday is the most since 107 was reached on December 5th. If we can get back to 100 new highs, the GMI could turn Green. Note that the IBD Mutual Fund Index (0MUTI) is now back above its 50 day average.