For the first time since last July/August, the gold chart looks ominous (see daily chart of GLD below). The 4 day average (red dotted line) has now crossed below the 10 day moving average (blue dotted line). GLD gapped down on huge volume 3 days ago and it has had 3 big volume down days (red spikes) since then. My perspicacious stock buddy, Judy, exited GLD (the gold ETF) 2 weeks ago after buying in around $70 in 2008. GLD has also now closed below its 4 week average, after having traded above this average since last summer. The long term support for GLD has been at its 30 week average since early 2009 and it is far above that now. If I were to bet on a short term down-trend in GLD, I would buy the double short ETN, DZZ. I would wait for a close of GLD below its 30 day average (solid red line), currently at $128.50. However, as long as GLD remains above its 30 week average, it remains in a Stage 2 long term up-trend.

ETF

This rally may have legs–IBD100 top ten out-shine again!

When everyone is so bearish and expecting the worst, it is time to expect the opposite. Last week, the Investor’s Intelligence Survey of letter writers and advisers actually showed more bears than bulls (38% vs. 29%, percents rounded). This is an exceedingly rare phenomenon and should have told us all that the market would rally. The survey is known as a contrary indicator, when there are many bears, the market goes up, presumably because many persons have already sold or are afraid because stocks have declined. When there are more than 50% bulls, it is time to start looking for a market decline. I am posting more explanations these days because I have a new class of undergraduate students who are new to these concepts.

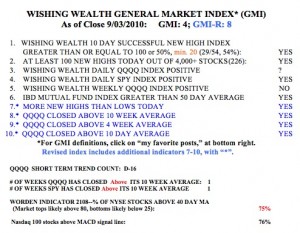

Meanwhile, the GMI is 4 (one more flat or up day could turn it to 5) and the more sensitive GMI-R is at 8.  It is now time for me to close out my few short positions and start going long. There are just too many stocks breaking out. There were 226 new 52 week highs on Friday in my universe of 4,000 stocks. This is the most new highs since August 9 (229). While the QQQQ short term trend is still down, by my count, it may end at Friday’s day 16 (D-16) if we have a flat or up day in the index on Tuesday. Both the SPY and DIA have closed above their critical 10 week averages, the level at which I can begin to trade profitably on the long side. 76% of the NASDAQ 100 stocks closed with their MACD above its signal line, a sign of near term strength. And the Worden T2108 indicator is now at 76%, getting close to overbought territory, but this indicator can remain around 80% for months. The T2108 measures the percentage of all NYSE stocks that closed above their 40 day simple moving averages. It behaves like a pendulum of the market, swinging from overbought to oversold…….

It is now time for me to close out my few short positions and start going long. There are just too many stocks breaking out. There were 226 new 52 week highs on Friday in my universe of 4,000 stocks. This is the most new highs since August 9 (229). While the QQQQ short term trend is still down, by my count, it may end at Friday’s day 16 (D-16) if we have a flat or up day in the index on Tuesday. Both the SPY and DIA have closed above their critical 10 week averages, the level at which I can begin to trade profitably on the long side. 76% of the NASDAQ 100 stocks closed with their MACD above its signal line, a sign of near term strength. And the Worden T2108 indicator is now at 76%, getting close to overbought territory, but this indicator can remain around 80% for months. The T2108 measures the percentage of all NYSE stocks that closed above their 40 day simple moving averages. It behaves like a pendulum of the market, swinging from overbought to oversold…….

As you know, I think the IBD approach to trading stock is quite effective. My strategy is to select stocks from the IBD 100 list, the top 100 stocks that meet the IBD CAN SLIM criteria. I then time the entry according to my own trading rules. The IBD100 list is published every Monday (this week on Tuesday) and is also available on their website for persons who subscribe to the newspaper. I am always amused how some traders dismiss the IBD100 list as containing stocks that have already passed their time. They say that when a stock appears on this list, it is too late to buy them. I think the evidence does not support this assertion. IBD100 stocks often outperform most other stocks, except during a market decline when these growth stocks can fall more.

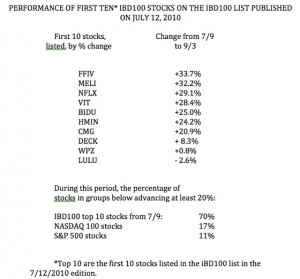

From time-to-time, I record the first 10 IBD100 stocks on the list and compare their performance to other stocks. I did this for the top ten stocks on the list published on Monday, July 12.  The top ten stocks are the first ten listed in the IBD100 table published each Monday, and presumably the most promising. I tracked the change in these ten stocks from the preceding Friday’s close (7/9) through last Friday. This table (click on to enlarge) shows the extraordinary out-performance of the ten IBD100 stocks. 90% (9/10) of these stocks rose in this period, with 70% rising 20% or more. In comparison, only 17% of the NASDAQ 100 stocks and 11% of the S&P 500 stocks rose at least 20%. This performance of the top ten IBD 100 stocks occurred while the QQQQ (NAASDAQ 100 index ETF) advanced 8%. While I do not necessarily concentrate my purchases among the top ten stocks on the IBD100 list, I do tend to concentrate on stocks that have appeared on the list or in the IBD New America daily columns. Almost every Friday, the New America page lists an archive of the companies written about during the past few months. I use this archive to update a watch list of promising stocks to follow. The first ten stocks on today’s IBD 100 list (published on Tuesday this week) are, in order: NFLX, ARUN, BIDU, PCLN, JKS, PPO, MELI, TSL, VIT, FFIV. I already own some of these. It will be interesting to see how these stocks perform over the next month.

The top ten stocks are the first ten listed in the IBD100 table published each Monday, and presumably the most promising. I tracked the change in these ten stocks from the preceding Friday’s close (7/9) through last Friday. This table (click on to enlarge) shows the extraordinary out-performance of the ten IBD100 stocks. 90% (9/10) of these stocks rose in this period, with 70% rising 20% or more. In comparison, only 17% of the NASDAQ 100 stocks and 11% of the S&P 500 stocks rose at least 20%. This performance of the top ten IBD 100 stocks occurred while the QQQQ (NAASDAQ 100 index ETF) advanced 8%. While I do not necessarily concentrate my purchases among the top ten stocks on the IBD100 list, I do tend to concentrate on stocks that have appeared on the list or in the IBD New America daily columns. Almost every Friday, the New America page lists an archive of the companies written about during the past few months. I use this archive to update a watch list of promising stocks to follow. The first ten stocks on today’s IBD 100 list (published on Tuesday this week) are, in order: NFLX, ARUN, BIDU, PCLN, JKS, PPO, MELI, TSL, VIT, FFIV. I already own some of these. It will be interesting to see how these stocks perform over the next month.

Major indexes remain in longer term down-trends; in cash or short

For those of you who are first time readers, welcome! I want you to know that I write this blog to share my experiences gained from trading over more than 40 years. I also write this blog to educate my students at the University of Maryland, who are enrolled in my classes on technical analysis of stocks. I am passionately committed to educating people about trading because I believe that our education system has failed to prepare its citizens for their financial survival. My students learn to greet assertions and advice from the pundits in the financial media with a heavy dose of skepticism and their own critical analysis.

As a part-time trader, I have educated myself through extensive reading of the works of successful traders and through analysis of my own trading performance. I bring my training as a research psychologist to the subject of trading. I have been able to multiply my IRA 14x since 1995 and have been able to keep my university pension safely in cash during all of the major market declines since 1998, and to reinvest the funds in the subsequent advances. My university pension has been spared the scars and heavy losses from the declines in 2000-2002 and 2008.

I rely heavily upon my General Market Index (GMI) to keep me on the same side as the major market trend. The GMI is a simple count of the six indicators that I use to gauge the market’s short and longer term trends. I exit to cash when my indicators signal a major down-trend, usually when the GMI is below 3. I wade back into the market slowly when the GMI recovers. I do not predict the length of trends, I try only to ride them until they end. The few excellent books that made a difference to my trading are posted to the lower right of this blog, and most are required reading before my students are allowed to formulate trading rules and test them in a virtual trading exercise. I compose each daily post after the market close, and publish it on Monday through Friday around 7:00 AM EST. While I publish the GMI reading every post, I present the GMI’s full components only on Monday morning. I hope that readers will benefit from my experiences and apply whatever they find useful to their own trading. I am empowered by your comments and ask that you give me feedback in the comment section of each post, or send them to me via email at: silentknight@wishingwealthblog.com.

———————————-

One reader chastised me for appearing to depart from my prior recent posts in which I wrote about a weak market. He said that if I began to question the down-trend, then Mr. Market had finally fooled me, and the market would fall. He was right, the market did decline on Friday, but I think it had little to do with my sentiment about the market. I have been saying that the longer term trend of the indexes remain down, even as my short term indicator for the QQQQ turned up late last week. According to my way of identifying the short term trend of the QQQQ (Nasdaq 100 index ETF), the market completed its third day of its new short term up-trend on Friday, which is a counter-trend move within a longer term down-trend. I have been showing you that the daily 10,4,4 stochastic statistic reached very overbought levels and the market was due for another dip. It was this overbought condition, and not the reasons posited by the media pundits why the market sold off.  So now we have to wait to see whether this dip will go to new lows or hold above them. You can see in this daily chart of the Dow 30 (click on chart to enlarge) that the stochastic at the bottom window (red line) has just curved down. Whether it will fall to oversold levels again is unknown, but note that all of the recent declines ended with the stochastic well below 50 . We just need to wait for the market to reveal its trend. I also use the stochastic to time my buys and sells. For example, I was not looking to take any new short positions while the stochastic was very low. By the way, the other two major index ETF’s I follow (SPY, QQQQ) show the same pattern as the Dow.

So now we have to wait to see whether this dip will go to new lows or hold above them. You can see in this daily chart of the Dow 30 (click on chart to enlarge) that the stochastic at the bottom window (red line) has just curved down. Whether it will fall to oversold levels again is unknown, but note that all of the recent declines ended with the stochastic well below 50 . We just need to wait for the market to reveal its trend. I also use the stochastic to time my buys and sells. For example, I was not looking to take any new short positions while the stochastic was very low. By the way, the other two major index ETF’s I follow (SPY, QQQQ) show the same pattern as the Dow.

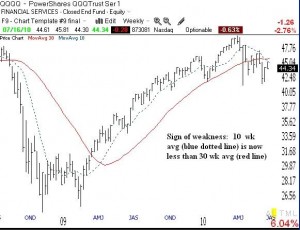

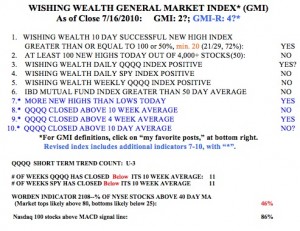

But all of this daily action is occurring within a weekly down-trend. It is the weekly down-trend that tells me whether to be in cash or in stocks. As you know, I have moved all of my university pension from mutual funds to money market funds recently. I could be wrong or perhaps premature in my timing, but my philosophy is to be in the market when we are in an established longer term up-trend and to stay on the sideline safely in cash otherwise.  I was able to remain invested for a long time while the GMI was at 4 or higher. But the GMI has been less than 4 for much of May and June and every day since June 22nd. As you can see, the GMI is now at 2? (of 6) and the more sensitive GMI-R (revised) is at 4? (of 10). The “?” indicates one of the indicators is too close to call. In addition, the Worden T2108 Indicator is at 46%, in neutral territory. Prior tops tend to occur when the T2108 is near 80% and bottoms when it is below 20%. (The T2108 measures the percentage of NYSE stocks that have closed above their simple 40 day moving average of price.) 86% of the Nasdaq 100 stocks have their daily MACD above its signal line, a sign of a short term up-trend. Finally, the QQQ and SPY have closed below their 10 week averages for 11 straight weeks. I cannot make money trading on the long side when these indexes are below their 10 week averages. More disconcerting is that the 10 week average is now declining below the 30 week average (click on weekly chart of the QQQQ below to enlarge).

I was able to remain invested for a long time while the GMI was at 4 or higher. But the GMI has been less than 4 for much of May and June and every day since June 22nd. As you can see, the GMI is now at 2? (of 6) and the more sensitive GMI-R (revised) is at 4? (of 10). The “?” indicates one of the indicators is too close to call. In addition, the Worden T2108 Indicator is at 46%, in neutral territory. Prior tops tend to occur when the T2108 is near 80% and bottoms when it is below 20%. (The T2108 measures the percentage of NYSE stocks that have closed above their simple 40 day moving average of price.) 86% of the Nasdaq 100 stocks have their daily MACD above its signal line, a sign of a short term up-trend. Finally, the QQQ and SPY have closed below their 10 week averages for 11 straight weeks. I cannot make money trading on the long side when these indexes are below their 10 week averages. More disconcerting is that the 10 week average is now declining below the 30 week average (click on weekly chart of the QQQQ below to enlarge).

So, to sum it up, I remain largely in cash or short. I will not trade long when the major averages are in longer term down-trends. When they reverse, there will be plenty of time to get back in during the next major longer term up-trend. Unfortunately, we have all been wrongly taught that we cannot time the market and should remain in the market all of the time. The most successful traders in history, exit the market or go short when the trend turns down.